In the current AI landscape dominated by headlines about Large Language Models (LLMs) like GPT-4 and companies like DeepSeek, it’s crucial to recognize that artificial intelligence encompasses a far broader spectrum of applications and technologies. While generative AI and chatbots capture public imagination, the healthcare industry, particularly medical imaging, leverages AI in ways that are less visible but potentially more impactful on human lives. Nevertheless, the recent advancements in computing power, algorithmic design, and implementation driven by generative AI technologies have far-reaching impacts across diverse industries and technological modalities.

This blog post focuses on AI in medical imaging, a field that primarily utilizes computer vision and specialized machine learning models rather than the text-based LLMs grabbing recent headlines. Unlike consumer-facing AI applications processing millions of queries daily, medical imaging AI operates in a more focused, high-stakes environment where accuracy and reliability trump processing volume. The distinct nature of healthcare AI is reflected in its specialized algorithms tailored to specific medical tasks and integrated into existing hospital infrastructure, setting it apart from the more publicized AI applications. This unique positioning within the healthcare sector presents both challenges and opportunities for AI adoption, industry partnerships, and potential market dynamics, which we will explore further in this post.

By delving into the nuances of AI adoption in medical imaging, this post illuminates a critical yet often overlooked sector of AI development—one where the measure of success is not viral popularity, but improved patient outcomes and more efficient healthcare delivery. While it’s tempting to view these AI solutions as a revolutionary force in healthcare delivery, it’s important to recognize that the field has experienced more of a gradual evolution over time. Rather than a sudden upheaval, the integration of AI in medical imaging might be better understood as a ‘Cambrian Explosion’ of innovation—a period of rapid diversification and advancement, but one that builds upon existing foundations. This perspective doesn’t diminish the massive implications of successfully implementing this technology, but it does provide a more nuanced understanding of its role in the ongoing development of healthcare practices.

Riding the AI Wave in Medical Imaging

Artificial intelligence (AI) has been steadily infiltrating the healthcare industry for many years. Investors have poured $60B into healthcare AI startups in the last decade, with $30B being invested in just the last three years [1].

Of the $60B invested in healthcare AI in the last decade, ~$23B has gone to companies that sell to hospitals and health systems[1]. Of this, only about $5B has been invested in the AI-enabled medical imaging companies — with the top 5 most funded companies being HeartFlow ($655M), Shukun Technology ($305M), Cleerly ($281M), Viz.ai ($252M), Infervision ($244M), and Aidoc ($238M) [2].

AI’s transformative potential has found a prime target in clinical care solutions, particularly in medical imaging. These AI-powered technologies promise a multifaceted impact: enhancing patient outcomes, alleviating provider burnout, increasing diagnostic accuracy, and enabling earlier disease detection. The convergence of AI and medical imaging represents a significant leap forward in healthcare delivery and efficiency.

Interestingly, while venture capitalists allocate only 5% of their healthcare AI investments to diagnostic imaging companies, health systems with dedicated AI budgets report investing nearly 50% of those funds into companies specializing in imaging, clinical decision support, and diagnostic value propositions[1]. This stark contrast suggests that the diagnostic imaging sector in healthcare AI may be significantly underinvested, despite its apparent importance to healthcare providers.

So… Why Does Adoption and Utilization of AI in Medical Imaging Still Seem Early?

Commercial adoption has been slower than anticipated. According to a 2024 Sermo survey of over 100 healthcare leaders across hospitals and other facilities, only 21% of respondents say they have integrated AI into medical imaging practice[3]. Similarly, an October 2024 survey conducted by HIMSS (Healthcare Information and Management Systems Society) suggests only 11% of surveyed organizations currently use AI-delivered computer vision algorithms for diagnostics and imaging[4].

There are several factors at play: the nascent reimbursement landscape, the lack of regulatory clarity, the inherent challenge of selling software that directly impacts care decisions, interoperability, and the all-important question of ROI for healthcare organizations. As a result, relatively few disruptors have managed to claw their way to commercial scale today.

Nonetheless, we have a positive outlook on the disruptors in this space.

At around 8%, medical imaging is a significant portion of US healthcare spend[5]. 60% of adults have ≥1 chronic condition requiring advanced imaging, and the US population is rapidly aging[6]. Additionally, we can expect a shortage of ~42k radiologists by 2033 – and today, nearly half of all radiologists are at retirement age[7]. Waste from misuse and overuse in diagnostic imaging alone is estimated to be more than $25 billion per year in the US[8].

There’s reason to believe adoption and utilization of AI solutions will continue to accelerate given these trends. Moreover, the regulatory and reimbursement environment continue to evolve as more value is recognized and clearer frameworks are developed.

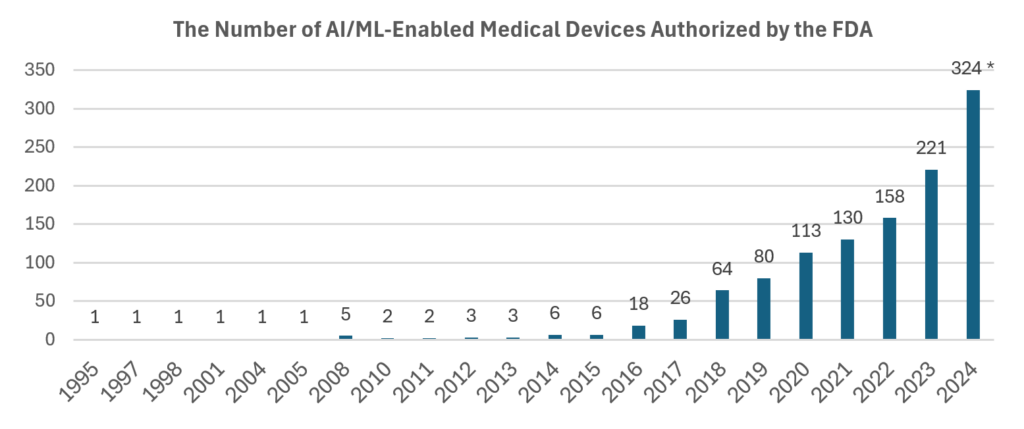

In the last few years, we’ve seen a significant uptick in the authorized AI/ML-enabled medical devices by the FDA (which includes both hardware and software)[9],[10].

This leap signals that the regulatory landscape has become more accommodating in recent years. This has been a crucial factor in fostering innovation and attracting additional investment in the field.

Additionally, at the end of 2024, the FDA finalized proposed guidance allowing manufacturers of AI-enabled medical devices to make changes to their AI-enabled solution without having to file a new submission (PMA, De Novo, or 510(k)). We expect this change to be of particular benefit to the emerging, scaled disruptors who now have the flexibility to iterate and improve upon their existing products without additional regulatory burden.

Another regulatory tailwind for the industry includes amendments to the 21st Century Cures Act. The 2024 ruling contains additional provisions against “information blocking.” This means that healthcare providers, health IT developers, and health information exchanges (HIEs) are prohibited from unreasonably interfering with the exchange or use of electronic health information (EHI). This is particularly important for AI in medical imaging because it promotes the flow of data necessary for training and deploying AI algorithms[11]. The final rule also emphasizes the need for greater interoperability between different health IT systems (EHRs, PACS). This means that systems should be able to exchange and use data seamlessly, regardless of the vendor or platform. This should in turn facilitate further innovation and access to high-quality data sets[12].

Finally, two-thirds of hospitals and health systems expect to increase their AI spending by ≥25% in the next three years[13]. The October ‘24 HIMSS survey suggests that 69% of healthcare organizations plan to adopt AI-enabled computer vision solutions in the next five years[4], while the aforementioned Sermo survey indicated 62% of healthcare leaders forecast medical imaging AI implementation within the next five years [3].

Navigating the Disruptors

While there is reason for optimism, it is important to evaluate the value proposition of individual solutions on a company-by-company basis in order to understand their commercial potential.

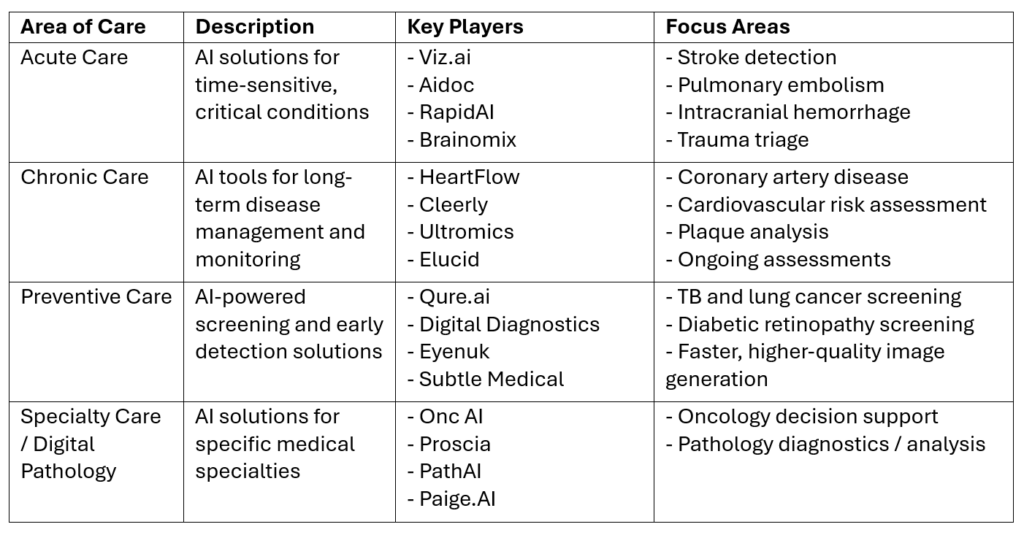

As we approach the framework for evaluating existing and potential disruptors, we focus on segmenting the companies based on the area of care. Segmenting companies in this manner allows us to compare solutions across similar healthcare delivery models and patient journeys. It also provides a framework to better assess the potential impact on healthcare outcomes and provider ROI across different care settings.

For the disruptors to achieve scale, the solutions must not only be safe and effective but also reasonable and necessary within the provider workflow and patient journey. Proving the latter can more generally be characterized as having a tangible ROI for the customer. While regulatory approval may seem like the biggest hurdle to many early-stage companies, demonstrating that the solution is reasonable and necessary is arguably more critical to ensuring the solution is utilized, commercially viable, and a viable candidate for reimbursement.

Companies that successfully demonstrate these characteristics can anticipate exceptional customer retention and rapid scalability. By aggregating substantial amounts of data in their respective verticals, these companies can build formidable competitive moats, iterating on existing solutions and swiftly developing new products. Even companies with initial commercial traction should expect the strategic value of their training data libraries to snowball. This growth stems from a virtuous cycle: as solutions are implemented, they facilitate ongoing data acquisition and refinement, which in turn drives continuous product improvement. This self-reinforcing process significantly enhances the company’s market position and value proposition over time.

We believe mature solutions with these characteristics make for a compelling long-term business model. Large, verticalized medical datasets continue to grow in strategic value and are expected to generate notable strategic partnerships, acquisition interest, and/or interests from the public markets.

Across the Areas of Care, Disruptors Achieve a Tangible ROI in Different Ways

Acute care solutions can vastly improve patient outcomes in high-cost, high-urgency indications like stroke – where every minute counts in preserving patient brain function. As an example, Viz.ai demonstrated a 40-minute reduction in patient arrival to first contact with the neurointerventionalist for potential emergency endovascular treatment[14]. Additionally, the software results in increased use of CTA (Computed Tomography Angiograph) and EVT (Endovascular Thrombectomy) interventions resulting in a direct increase in associated hospital revenue – as well as a decrease in payor costs associated with worse outcomes. Companies in this space will need to prove they can expand into multiple, high-value acute indications as well as find new ways of unlocking the tremendous value associated with the data they can aggregate.

Chronic care solutions: similar to acute care, these solutions focus on improving patient outcomes, reducing diagnostic pathway costs, and improving operational efficiency. However, given the longer-term nature of the indications, cost savings and ROI aren’t as immediately obvious to the healthcare organization when compared to acute care solutions. As a result, reimbursement plays a more significant role in the adoption of these solutions. Centers using Heartflow’s AI-enabled non-invasive plaque quantification technology saw better outcomes and lower mortality. In addition, the solution changed clinical management decisions in up to 67% of patients while both significantly reducing the time to definitive diagnosis and lowering the cost of care by 26% compared to typical care pathways[15]. However, it wasn’t until 2024 that the AMA officially recognized the necessity of these solutions and formally approved a category I CPT code for quantitative coronary tomography and coronary plaque analysis. We expect adoption and utilization of the covered solutions to significantly accelerate in the coming years given the clear ROI these products and the associated reimbursement can afford their healthcare organization users (Cleerly’s ISCHEMIA device, HeartFlow’s Plaque Analysis, and Elucid’s PlaqueIQ)

Preventative care solutions can unlock significant value by enabling early detection and intervention across high-cost indications, potentially reducing the burden of various chronic diseases and associated healthcare costs. These AI-powered tools enhance screening efficiency and accuracy. For instance, Qure.ai’s chest X-ray AI has demonstrated high accuracy in detecting abnormalities, with 96% sensitivity and 100% specificity for identifying missed and mislabeled findings[16]. Digital Diagnostics’ IDx-DR, the first FDA-approved autonomous AI diagnostic system for diabetic retinopathy, has shown 87% sensitivity and 90% specificity in detecting mild diabetic retinopathy[17]. To fully unlock their value and achieve widespread adoption, companies in this space need to focus on several key areas. First, they must continue to demonstrate clear ROI and cost-effectiveness to justify the upfront implementation costs. Second, securing robust reimbursement pathways is crucial, as seen with the gradual acceptance of AI-based diabetic retinopathy screening. Third, addressing implementation challenges through flexible pricing models and comprehensive support will be essential. Finally, expanding applications and integrating with existing healthcare workflows—such as Eyenuk’s EyeArt AI system potentially expanding beyond diabetic retinopathy screening—will increase their value proposition and drive adoption.

Specialty care and digital pathology solutions are improving diagnostic accuracy and efficiency in complex medical fields, unlocking value and demonstrating ROI through improved patient outcomes and operational efficiencies. In dermatopathology, AI-powered tools like those developed by Proscia have shown remarkable potential in enhancing diagnostic processes. For instance, Proscia’s DermAI has demonstrated high accuracy in categorizing skin biopsies into major diagnostic categories, with a concordance rate of 94% with expert dermatopathologists[18]. This technology has the potential to significantly reduce turnaround times and enhance diagnostic consistency. However, to realize their full potential, companies in this sector face unique challenges. Improving the reimbursement landscape is crucial, with organizations like the Digital Pathology Association actively engaging with CMS to establish appropriate reimbursement codes and rates for digital pathology services. Companies must continue to produce robust evidence of their solutions’ clinical and economic benefits to gain acceptance from both clinicians and payers. Addressing infrastructure and integration challenges through cost-effective solutions or alternative business models will also be key to making these technologies more accessible, particularly for smaller laboratories. Enhancing interoperability and promoting standardization across the industry will help streamline workflows and reduce implementation barriers. Finally, as AI becomes more integral to digital pathology, companies must navigate the evolving regulatory landscape, working closely with regulatory bodies to establish clear guidelines for AI-powered diagnostic tools. By addressing these challenges, specialty care and digital pathology companies can unlock additional value and drive wider adoption of their innovative solutions, potentially improving diagnostic accuracy and accelerating research and drug development in the process.

Conclusion

The medical imaging sector’s highly specialized nature, coupled with stringent regulatory requirements and complex reimbursement structures, creates significant barriers for new entrants in the AI space. These factors give incumbent medical imaging companies a strong advantage. Developing effective AI for medical imaging requires not just advanced algorithms, but also deep understanding of clinical workflows, access to vast, high-quality medical datasets, and navigation of complex healthcare regulations. The FDA has developed specific guidelines for AI-enabled medical devices, demanding rigorous validation processes; additionally, the challenge of establishing appropriate reimbursement models for AI-enabled imaging services adds another layer of complexity. Given these hurdles, we expect to see more partnerships and acquisitions in this field, rather than direct competition from general AI companies. This collaborative approach allows for the combination of cutting-edge AI capabilities with the crucial domain expertise and regulatory know-how of established medical imaging players, potentially accelerating the development and adoption of AI in this critical healthcare sector.

Evaluating the emerging and existing disruptors in the AI-enabled medical imaging space demands a nuanced, company-specific assessment of the value proposition. The diversity in business models, technological offerings, and integration into customer workflows precludes a universal formula for success in this sector. While many emerging and established companies are poised to become leaders in their respective niches, true success hinges on more than just improving patient outcomes. These technologies must fundamentally transform care delivery methods to achieve lasting impact and market dominance.

[1] Flare Capital Partners; Where do Healthcare Budgets Match AI Hype? A 10-Year Lookback of Funding Data

[2] Signify Research; Investment in Medical Imaging AI Tops $5B

[3] Radiology Business: Only 21% of Healthcare Leaders Say They’ve Implemented AI in Medical Imaging

[4] HIMSS; Healthcare Leaders Consider AI and Data Sharing for Modernizing IT Infrastructure

[5] Radiology Business; Imaging’s Total Share of US Healthcare Spending Plummets as Others Record Gains

[6] CDC.gov; Chronic Diseases in America

[7] Becker’s Hospital Review; The Radiologist Shortage, Explained

[8] Newman-Toker DE et al.; How Much Diagnostic Safety Can We Afford, and How Should We Decide? A Health Economics Perspective

[9] MedTech Dive; The Number of AI Medical Devices has Spiked in the Past Decade

[10] Exponent.com; FDA Finalizes Guidance for AI/ML Medical Devices

[11] RXNT.com; The 21st Century Cures Act Effect on Patients, Physicians, and Interoperability

[12] HealthIT.gov; Health Data, Technology, and Interoperability: Certification Program Updates, Algorithm Transparency, and Information Sharing (HTI-1) Final Rule

[13] HealthcareITLeaders.com; IT Leadership Survey Finds Healthcare Systems Ramping Up AI Investment and Adoption

[14] TSTelemed.com; Large Real-World, Multi-Center Study Demonstrates Viz.ai Platform Saves Critical Minutes In Stroke Care

[15] Brown University; HeartFlow Analysis

[16] Qure.ai; Performance of a Chest Radiography AI Algorithm for Detection of Missed or Mislabeled Findings: A Multicenter Study

[17] AAFP.org; IDx-DR for Diabetic Retinopathy Screening

[18] Proscia; Proscia® Publishes Results Demonstrating Real-World Relevance of Artificial Intelligence in Pathology