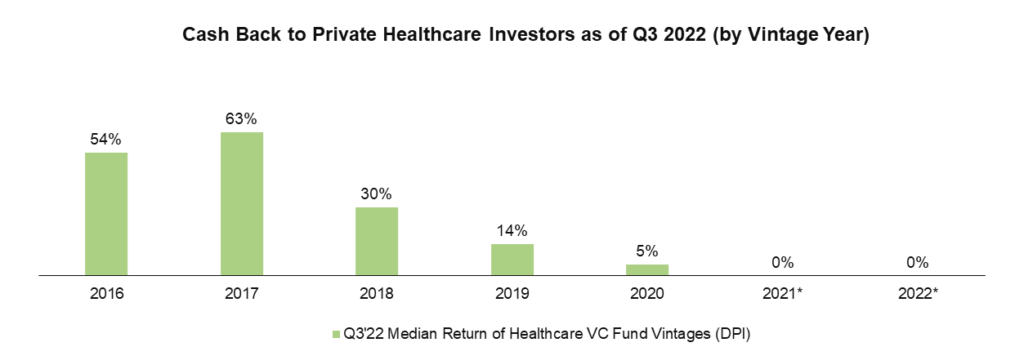

Want to raise capital for your healthcare startup? Go to Sprout, Three Arch, Healthcare Ventures, Morgenthaler, Interwest, Forward, Psilos… right? Well unfortunately, these firms do not exist anymore. A decade long J curve and a Great Recession eliminated them. Despite a string of vintage year strikeouts in the mid-2000s, the allure of “disrupting” healthcare with technology has allowed a new cast of characters to fill the void. Groups like DCVC, Transformation, Samsara, Westlake, Section 32, and many more have replaced the old stalwarts. Surprisingly, since 2015, almost 100 new healthcare venture “franchises” have been formed [1] and raised over $61 billion [2] to invest in healthcare start-ups. Even more astounding is that over $30 billion has been raised by new healthcare franchises since 2018 [3] alone. These “first time” or “emerging managers,” collectively with legacy healthcare players, have invested over $300 billion [4] into private healthcare companies over the same time period (since 2015). In contrast, liquidity has not been as forth coming. Benchmark data from Cambridge Associates indicates that on average, these funds have returned less than 35% of every dollar invested to their limited partners.

This disparity between heavy deployment, capital raising, and sparse liquidity parallels the same set of challenges that faced the old healthcare VC guard. It has taken longer and more money to drive healthcare start-ups to exit.

*Newer vintages, on average, two years out, have yet to return capital [5]

Usually, this track record can be offset by raising money on the prospect future liquidity for newer franchises. However, just as their predecessors experienced in the 2000s, the IPO window is closed. Further, unlike that period of time, there have been other complexities that have exacerbated liquidity for LPs including a high interest rate environment and a series of delayed acquisitions related to COVID.

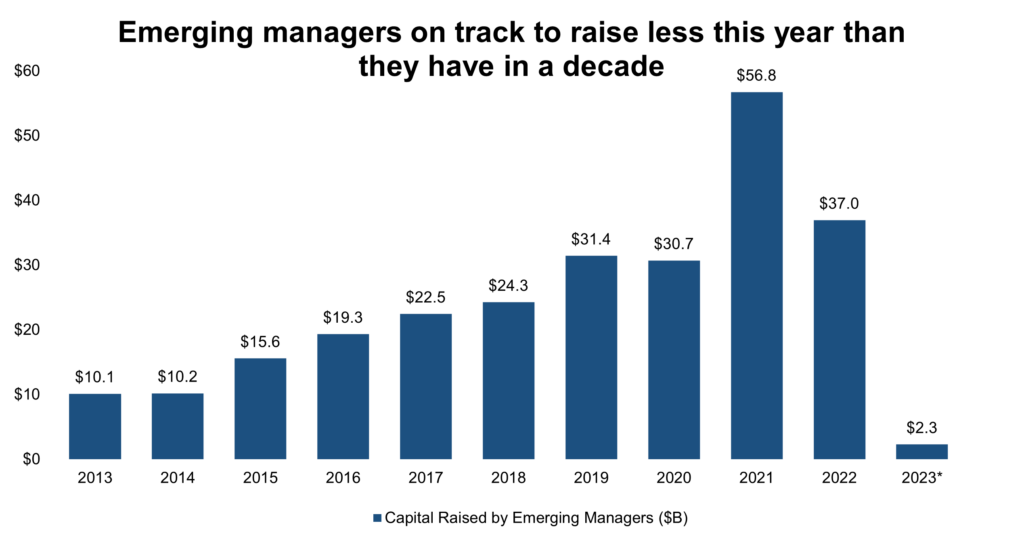

In contrast to the anemic liquidity realized by private healthcare investors, the pace of investment by emerging managers has been higher than originally planned when they raised their funds. As a result, many of these managers are now ready to raise another fund or are in the market trying to raise another fund. However, in a market with sparse liquidity, attracting new commitments from limited partners has proven difficult with emerging manager fundraising down precipitously over the last 12 months. Specifically, emerging managers across all industries were able to raise over $100 billion between 2021 and 2022. That number has fallen precipitously, by over 95%, to an annualized $5 billion:

[6]

However, unlike the 2000s period, there is a new tool that exists for these emerging managers to provide liquidity to their limited partners. Much like the public fund ecosystem has long had redemptions as a way for hedge fund investors to realize their return or get their money back, the private fund ecosystem has deployed a tool that has come to be known as a “continuation fund/continuation vehicle” or “CV” for short. CVs have become quite useful in converting unrealized gains into realized returns for the limited partners of emerging managers at attractive prices.

Much has been written about CVs (you can read more on the topic here and here), which has become a large market, representing $46 billion of the broader secondary market (as of YE22):

*The above graph shows all “GP-Led” Transactions – <10% of GP-Led Transactions are not CVs [7]

A common belief held by advisors is that this tool will be available to fund managers for the foreseeable future. What has changed over the last five plus years is that CV have become more flexible. Initially, CVs were used by the multi-billion dollar, diversified private equity managers – the Clearlakes, Warburg Pincuses, and TPGs, of the world – in billion-dollar fund transactions that had multiple assets. These transactions helped these large franchises return capital to their LPs allowing them to raise even larger flagship funds ($14B by Clearlake, $15B by Warburg Pincus, $20B+ by TPG) [8]

As the market for CVs has evolved, sub billion-dollar deal sizes have become more prominent and the use cases for CVs have become more flexible. Larger healthcare managers such as Towerbrook, Webster, Amulet, Waterstreet, and others have successfully completed CVs around a single company, providing a component of unfunded capital for future growth opportunities at the company-level.

As the market matures, we believe the use case for CVs will continue to evolve and that they will be a viable tool for many of the emerging fund managers to return capital to their LPs and thus, in turn, attract new commitments for new funds. With a healthy advisory market that includes groups like Park Hill, Evercore, Jefferies, Cogent, Cambell Lutyens, and Greenhill, there is a wealth of knowledgeable advisors who can guide a manager to successfully execute a continuation vehicle.

For more information on Revelation’s Fund Solutions portfolio, please visit https://www.revelation-partners.com/fundmanagers, and read our whitepaper on GP-Led Restructurings.

[1] RP Analysis, sourced via Pitchbook [2] RP Analysis, sourced via Pitchbook [3] RP Analysis, sourced via Pitchbook [4] Pitchbook-NVCA Monitor Q2’23

[5] RP Analysis, sourced via Cambridge Associates Fund Benchmarks Q3 2022

[6] Challenges for Emerging Mangers: How recent headwinds are shaping the proving grounds for US VC fundraising, June 2023; data as of April 17, 2023

[7] RP Analysis, sourced via Cambell Lutyens

[8] RP Analysis, sourced via Pitchbook and Secondaries Investor: Which top PE managers have used continuation funds? August 2021.