In the current interest-rate environment, many investors have been re-thinking their asset allocation strategies in order to meet or maximize their annual return targets. With many potential asset classes and sectors vying for investors’ allocation, we continue to believe that private healthcare investing is a conservative strategy during market volatility, with a potential for outsized performance and asymmetric return.

Why Invest in Healthcare as a subsector?

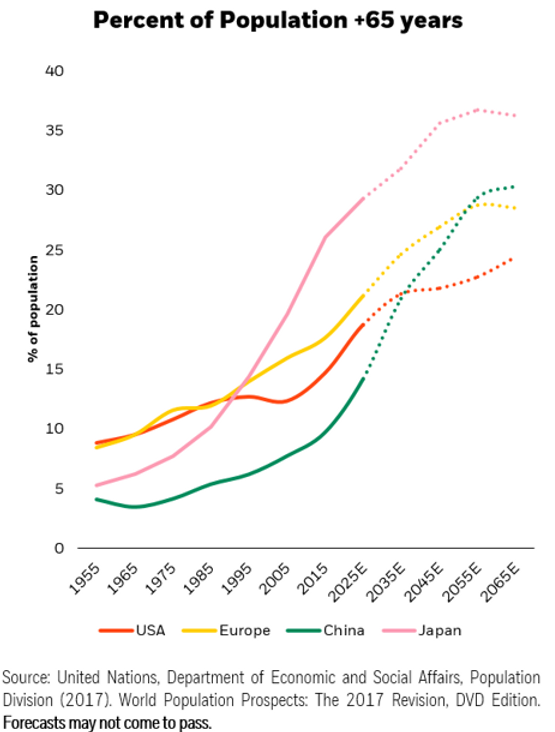

Healthcare has long been considered a “defensive growth” sector, given that that there has historically been limited correlation with global macroeconomic conditions – demand for healthcare is traditional stable and there is limited impact from swings in the economy. This is further supported by growing demographic trends as populations age and the wealth of the middle class rises.

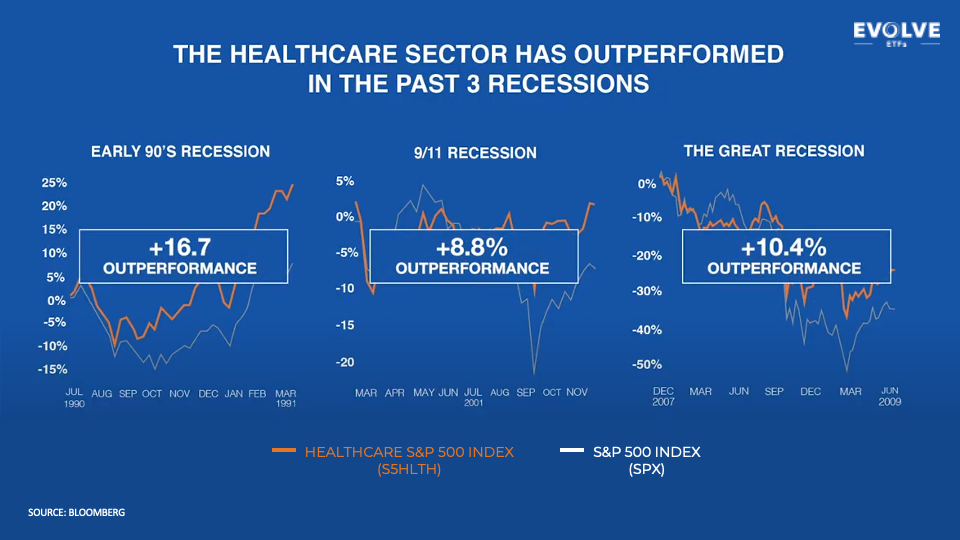

Public healthcare stocks have also outperformed the broader market during the past three recessionary cycles:

We saw a glimmer of this last year as well: In 2022, the S&P 500’s healthcare sector index was down <10%, on pace for its worst year since 2008. Yet it has still outperformed the broader market by >10 percentage points, the widest gap since 2000, according to Dow Jones Market Data.

Why Invest in Healthcare Private Equity?

While healthcare will continue to be a strong and stable sector for investment, we believe investing in private healthcare companies in particular can meaningfully drive alpha in investor portfolios.

In reviewing private equity data from the past two recessions, it is clear that investing in private healthcare is “recession-proof” and outperforms public equities on a risk-adjusted basis: the median IRR for healthcare PE following the dot-com recession was 45% (vs. 30% IRR of the broader PE market). Two years following the 2008 recession, IRRs for healthcare PE were 22%, in-line with the broader PE market, and outperforming the S&P index (15% annual return):

In addition, healthcare Private Equity tends to offer an evergreen source of deal opportunities since innovation is constant due to macro-level tailwinds. Healthcare consistently represents ~20% of US GDP. Factors such as a growing aging population, people living longer with chronic diseases, the obesity and diabetes epidemics, the global reach of diseases, and the growing adaptation to personalized medicines, not only create stable demand for the industry but drive constant transformation of the healthcare system. The speed of this innovation is also accelerating as we learn more about human biology, and leverage technologies from other industries. All of these factors create multiple diversified opportunities for investment in the private markets.

In conclusion, investors have many opportunities today to diversify their holdings and maximize their asset allocation strategies in order to drive alpha. We continue to believe that investing in private healthcare companies is an attractive opportunity given (1) macro-level tailwinds affecting the sector, (2) outperformance of the sector relative to the broader market, especially in recessionary periods, and (3) outperformance of healthcare private equity in particular, relative to the broader market. For more information on our Revelation’s approach for investing in private healthcare companies, please visit https://www.revelation-partners.com/our-focus.