In mid-2023, we published a report on how a secondary strategy can assist GPs in raising capital. We touched upon the challenging fundraising environment that emerging managers face and how continuation vehicles are evolving to cater to the needs of emerging managers as they seek to establish a track record of distributions for LPs. In this series, we dive deeper into the fundraising environment for emerging managers and assess why emerging managers in healthcare stand to disproportionately benefit from building a track record of distributions via a secondary toolkit.

The Fundraising Environment for Emerging Managers has Continued to Deteriorate

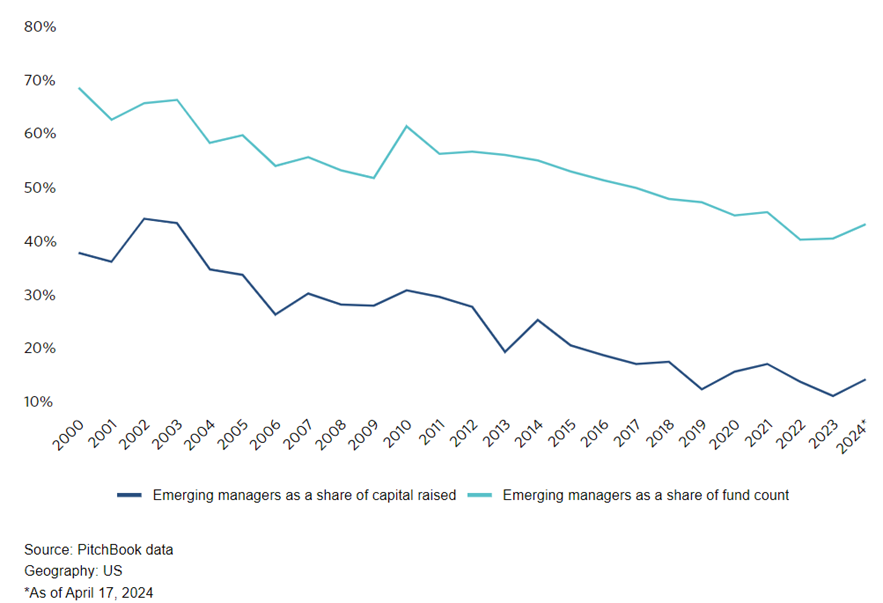

By the end of 2023, emerging managers across all sectors saw their share of US private market fundraising fall to 12.7% — the lowest share of capital raised by newer fund managers since before 2000. In the first quarter of 2024, this ratio saw a slight uptick [1].

However, halfway into 2024, emerging fund managers are on track to raise less than they did in 2023. Out of the $37B of venture funds raised in the first half of 2024, only $8.6B was allocated to emerging managers compared to $26.5B in the full year of 2023 [2].

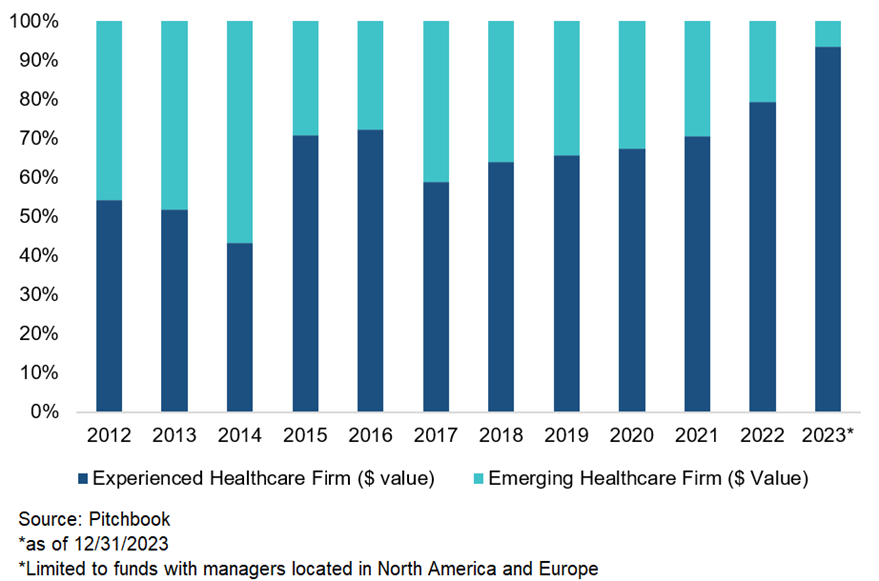

For emerging managers in healthcare, things look particularly bleak. These investors were allocated only 6.5% of the ~$20B in healthcare venture capital raised in 2023 [3]. What’s worse, for the last seven years in a row Emerging Managers have raised a lower percentage of the dollars allocated to private healthcare with 2024 on pace to be the lowest percentage (6.5%).

The Reason for the Decline is Clear – And It’s Not Unique to Emerging Fund Managers

It’s selection bias. LPs are prioritizing managers who can deliver distributions and cash flow. This focus is amplified by the extended period of illiquidity we’ve experienced since 2022.

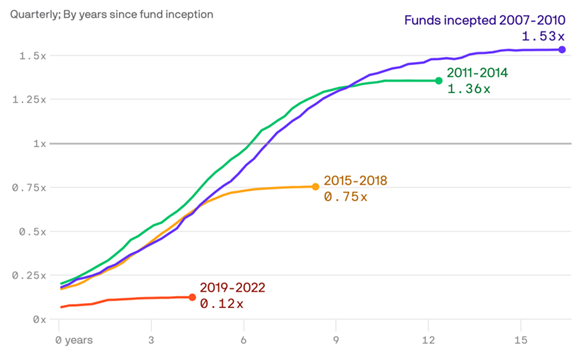

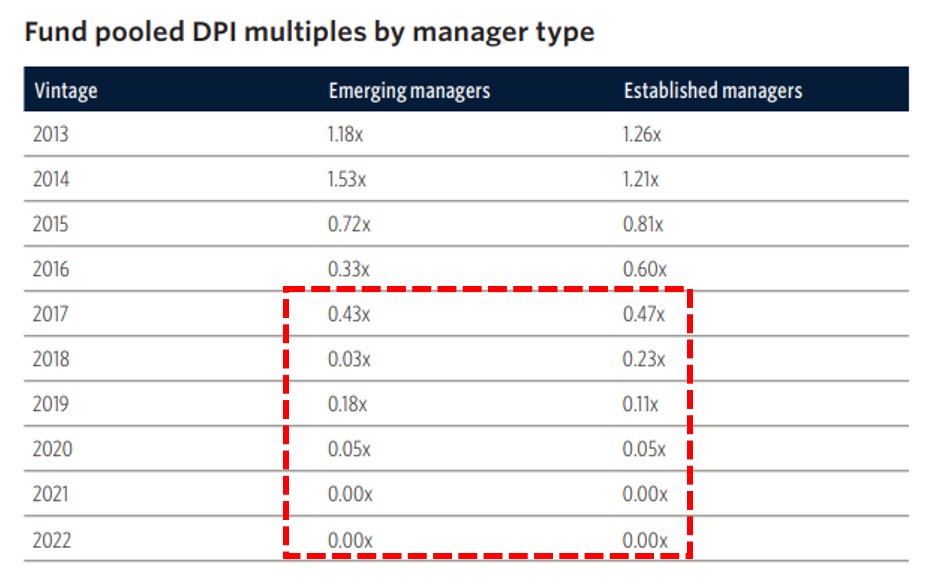

Pitchbook defines emerging managers as those who have successfully raised three or fewer funds. Emerging managers are, by definition, less likely to have a track record of distributions — but more importantly, they are less likely to be in vintages before 2015. Unfortunately for this cohort of emerging managers, post-2015 vintages have drastically underperformed in delivering DPI relative to older vintages (as seen in the graphic below) [4].

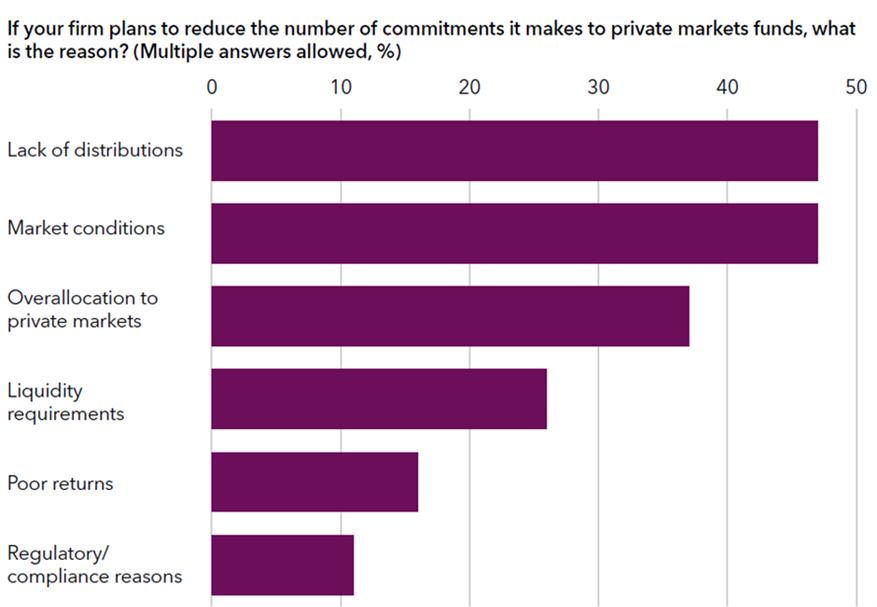

While established managers can point to older, better vintages to showcase a track record of DPI if their recent vintages underperform, emerging managers are not afforded this luxury. Moreover, when surveyed directly, LPs flagged that a lack of distributions represents the number one reason for reduced commitments [5].

Notably, “lack of distributions” was ranked above “poor returns” — underscoring the importance of delivering on liquidity even at the expense of overall TVPI (which should be expected when exploring secondary liquidity options).

We believe this data should serve as a strong indicator to all GPs, emerging or established, that generating distributions via secondary liquidity tools is an in-favor path to delivering DPI and standing out to LPs in the fundraising process. In particular, emerging healthcare specialists stand to benefit the most.

For more information on how GP-led secondaries can facilitate DPI for LPs and assist in the fundraising process, please refer to our March 2024 Secondary Spotlight with Todd Miller, the Global Co-Head of Private Capital Advisory at Jefferies. For more general information on the key considerations around GP-led secondary transactions for fund managers, please check out our whitepaper on the topic.

Why do Emerging Healthcare Specialists Stand to Benefit the Most from Secondary Solutions?

Amidst the fight for allocation, secondary liquidity solutions provide emerging managers with an avenue for survival and an opportunity to play to their differentiating advantages. An emerging healthcare specialist with a track record of DPI will clearly stand out from an established manager with a similar track record. Why?

- Firstly, because emerging specialists can play to the strengths inherent to their return profile (emerging specialists tend to deliver higher returns than established peers).

- Secondly, emerging healthcare specialists are strategically positioned to cater to the needs of increasingly sophisticated LPs with a growing interest in healthcare as an asset class.

- And thirdly, a lack of liquidity is not unique to emerging managers. The last eight vintage years hold the same dearth of distributions for everybody. Therefore, emerging managers with a track record of DPI have a leg up on both emerging and established peers across more recent vintages.

1. Emerging specialists can play to the statistical strength of their return profile

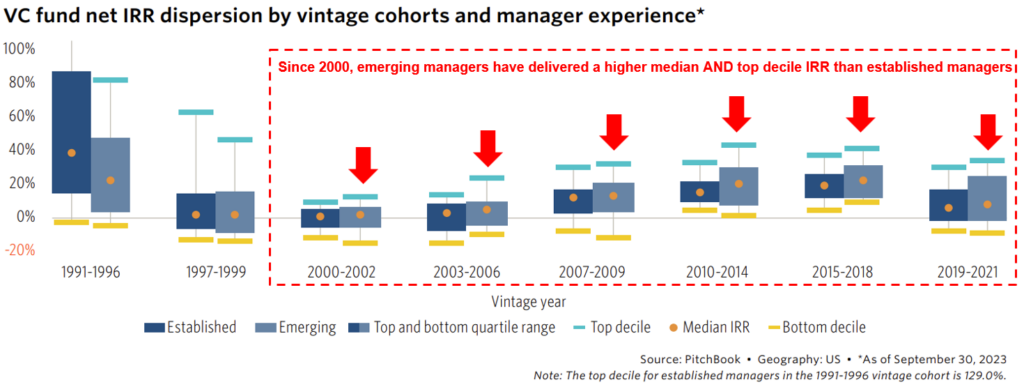

An emerging specialist who utilizes secondary liquidity tools to build a track record of DPI may be well positioned due to the unique return profile of emerging managers. Currently, the market’s focus on DPI overshadows this fact. Despite increased volatility, emerging managers have delivered a higher median and top decile IRR than the established managers in the years following 2000 [6].

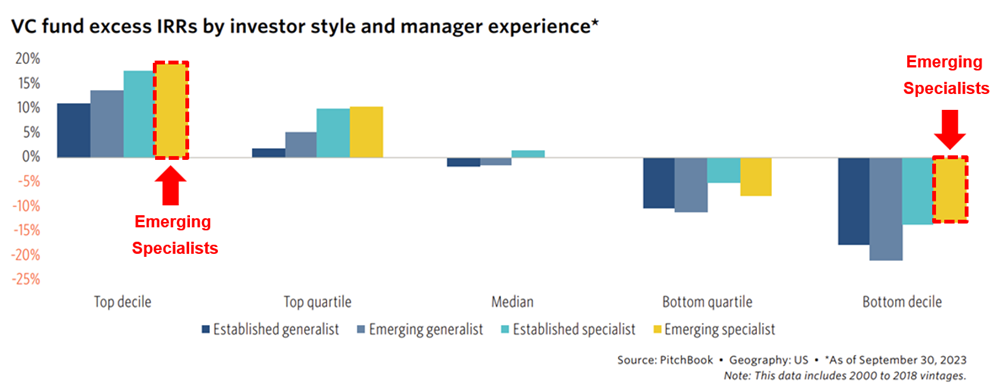

Furthermore, emerging managers with a specialist edge tend to outperform both emerging generalists and established specialists in both the upside and the downside net IRR performance deciles as seen in the chart below [6].

2. Emerging healthcare specialists are strategically positioned to cater to the needs of increasingly sophisticated LPs with growing interest in healthcare

Without an established track record of distributions today, the strategic advantages provided by emerging healthcare specialists are more difficult for LPs to focus on. But if an investor can satisfy that condition via the available secondary liquidity tools, the tailwinds for this investor class may begin to materialize.

Emerging managers can provide LPs like family offices with agility, opportunities for long term relationships, and a willingness to work with smaller investors. For emerging specialists, they can additionally provide a powerful strategic relationship.

According to EY, there’s been a notable rise in family offices directly investing in companies over the last decade, with 83% of single-family offices worldwide considering direct investments in 2024 [7]. As LPs become more sophisticated in direct investing, specialist managers will play a more important role in complementing LP’s existing investment infrastructure. A recent Denton survey of 188 family offices describe that 65% of LPs believe healthcare is the most attractive area of direct investment in 2024 [8], but only 35% of family offices have the dedicated internal resources available to support risk monitoring of specific sectors which underscores the need for partnerships with healthcare specialists [9].

3. A lack of liquidity is not unique to emerging managers; therefore, emerging managers with a track record of DPI have a leg up on both emerging and established peers

In the last 20 years, LPs deployed over $1.0 trillion into venture. Over half of those dollars were deployed after 2020 [10], and only ~4.1% of the capital deployed in the vintages between 2019 and 2024 has been distributed [11].

LPs are eager to see at least some portion of this cash distributed before making new commitments to managers (emerging or established). According to the table below, emerging managers have somewhat underperformed in delivering distributions historically — but since 2016, this underperformance has spanned both established and emerging managers alike [12].

Because a lack of DPI is a trait shared by both established and emerging managers, a track record of distributions can stand out as particularly impressive for emerging managers (who do not have earlier, better vintages to fall back on).

The Main Takeaway: Today, A Track Record of Distributions Matters Above All Else

Due to the recent years of constrained cash flow to LPs, the bar is permanently raised for emerging managers. Now they face a fundraising crisis — but emerging healthcare specialists should not let a good crisis go to waste. Secondary solutions can provide an outsized benefit: both a path to survival and a golden opportunity to stand out from their fund manager peers (emerging and established).

For more information on how DPI impacts the private fundraising environment and the secondary landscape, check out our April 2024 Secondary Spotlight with Gerald Cooper, the Head of North American Secondary Advisory Practice at Campbell Lutyens.

The secondary toolkit available to emerging managers can provide GPs and LPs with an additional level of adaptability. Some of the secondary liquidity tools available include direct secondaries, continuation vehicles, fund staples, strip sales, preferred equity, and other forms of partnership capital. For a general overview of the different types of secondaries solutions available today, please refer to our whitepaper on the topic.

For more information on Revelation Partners, the healthcare secondary market environment, and the secondary solutions available today, please visit https://revelation-partners.com/news-insights/.

Footnotes:

[1] Pitchbook; The weight of the emerging manager, May 3, 2024

[2] Pitchbook Benchmarks with preliminary Q1 2024 Data

[3] Pitchbook: H2 2023 Healthcare Funds Report Summary

[4] Analysis by Michael A. Greely / Flare Capital, sourced via Goldman Sachs, Preqin, Dealogic

[5] Private Equity International LP Perspectives Survey

[6] Pitchbook Analyst Note: Establishing a Case for Emerging Managers

[7] EY: The Future of Family Offices: A Look Ahead to 2024

[8] Dentons: Family office direct investing survey report, pg 21

[9] Dentons: Family office direct investing survey report, pg 23

[10] Pitchbook-NVCA Venture Monitor, Q2’24 NVCA

[11] Pitchbook-NVCA Venture Monitor, 2024 NVCA metrics