23andMe Raises More Than $80 Million in Equity Financing Round

DNA testing company 23andMe Inc. raised more than $80 million in equity in a financing round led by Sequoia Capital and NewView Capital. According to Securities and Exchanges Commission filings, the company offered $85 million in equity and sold about $82.5 million…

SomaLogic Adds $81M to Series A Financing Totaling $214M

SomaLogic, Inc., global leader in proteomic discovery and applications transforming biomedical discovery and clinical diagnostics, announced today that it added $81M to its current funding round with investments from a number of additional investors, for a total Series A raise of $214M.

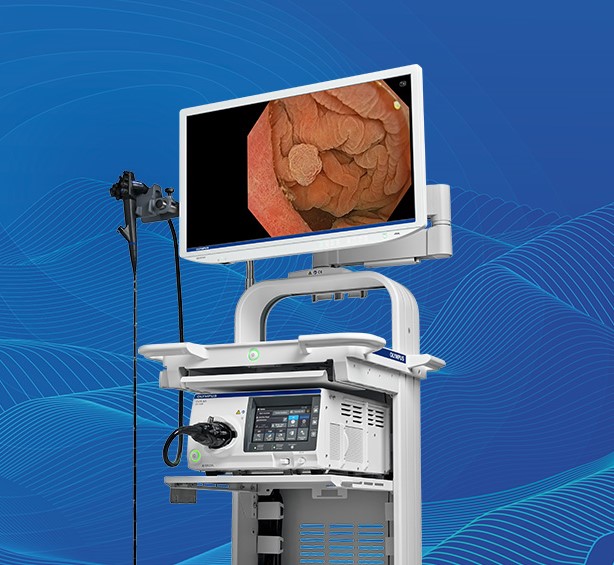

Olympus Grows Respiratory Portfolio with Acquisition of Veran Medical Technologies, Inc.

Olympus Corporation today announced that it has entered into an agreement to acquire Veran Medical Technologies, Inc. (VMT), a leading provider of advanced medical devices specializing in interventional pulmonology, for up to USD 340 million.

HotSpot Therapeutics Closes $100M Series C to Advance First-in-Class Allosteric Drug Discovery Platform to the Clinic

HotSpot Therapeutics, Inc., a biotechnology company pioneering the discovery and development of first-in-class allosteric therapies targeting regulatory sites on proteins referred to as “natural hotspots,” today announced the close of its oversubscribed $100 million Series C financing, bringing its total funding to $190 million.

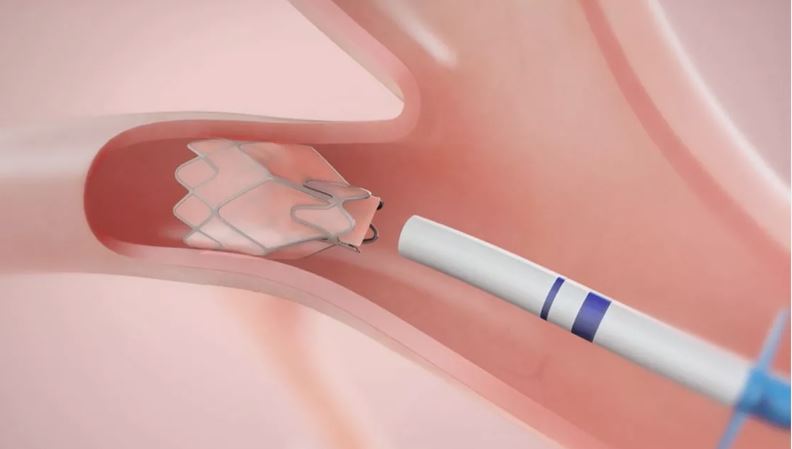

Pulmonx Corporation Announces Pricing of its Upsized Initial Public Offering

Pulmonx Corporation (“Pulmonx”) today announced the pricing of its upsized initial public offering of 10,000,000 shares of its common stock at a price of $19.00 per share, for gross proceeds of $190,000,000 million, before underwriting discounts and commissions…

Tender Offers: A Guide for Late-Stage Private Companies

In this white paper, we cover:

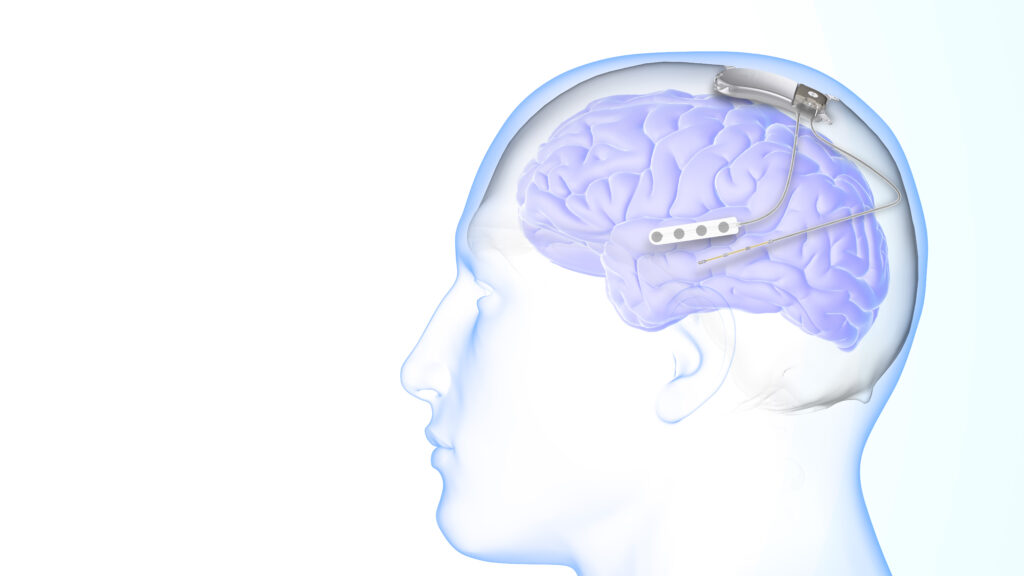

NeuroPace Raises $67 Million Financing to Support Commercial Expansion of the RNS® System for Refractory Epilepsy

MOUNTAIN VIEW, Calif.–(BUSINESS WIRE)–NeuroPace, Inc., a Silicon Valley-based medical technology company, today announced it has raised $67 million in a funding round led by Accelmed Partners with participation from an unnamed strategic investor…

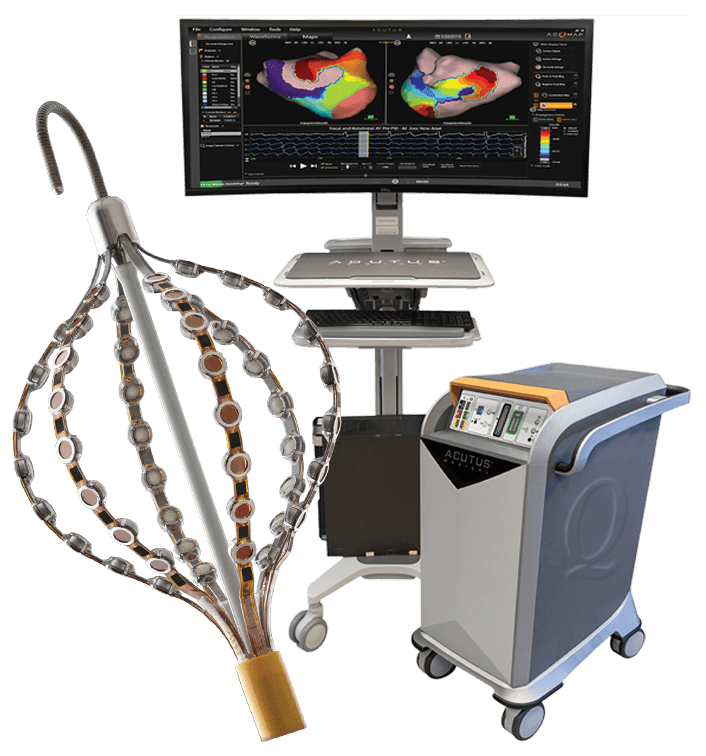

Acutus Medical Announces Closing of Initial Public Offering and Full Exercise of Underwriters’ Option to Purchase Additional Shares

CARLSBAD, Calif., Aug. 10, 2020 (GLOBE NEWSWIRE) — Acutus Medical, Inc. (“Acutus”) (Nasdaq: AFIB), today announced the closing of its initial public offering of 10,147,058 shares of common stock, which includes the exercise in full of the underwriters’ option….

Preventice Solutions Announces $137 Million Series B Financing Led by Vivo Capital Company Sees Record Growth for Its Technology Powered by Deep Learning and Artificial Intelligence

Preventice Solutions, a leader in digital healthcare solutions and remote cardiac monitoring services powered by deep learning and artificial intelligence (AI), today announced that it has raised $137M in a Series B financing to accelerate investment in salesforce expansion…

IntelyCare Completes Largest Venture Round in Nursing; Raises $45M to Solve Nationwide Workforce Shortage

IntelyCare, a leading intelligent workforce management solution for post-acute facilities, today announced it has completed the largest venture round in the nursing technology space, raising $45M in new equity and debt financing to solve the nationwide workforce shortage.