Disclaimer: Revelation Partners is invested in Carrum Health, Bristol Hospice, Genome Medical, and Metabolon.

Fragmented, Costly, and Complex: The State of U.S. Cancer Care

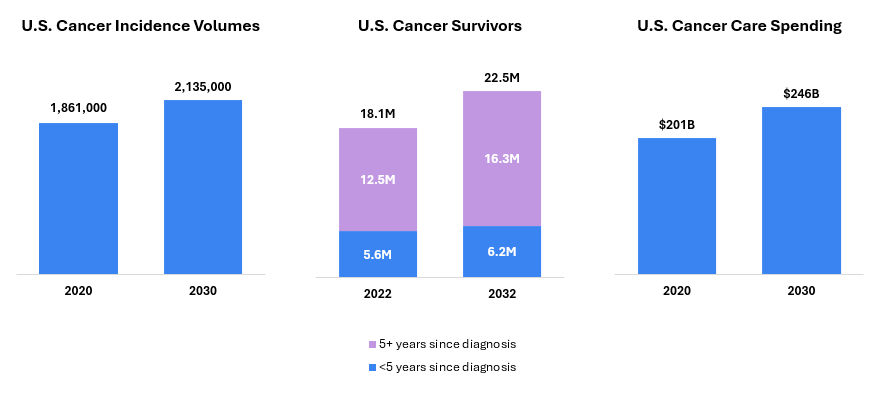

Over the past century, we have made remarkable strides in the fight against cancer—from the advent of chemotherapy in the 1940s to today’s targeted, immune, and cell-based therapies that have expanded the therapeutic arsenal across nearly every tumor type. Yet, despite these remarkable clinical advances, cancer remains the second leading cause of death in the U.S.[1], with almost two million new diagnoses expected in 2025[2]. As the number of new treatments has expanded, the clinical context for cancer has also evolved. Cancer care—defined as the non-therapeutic infrastructure, technology and services involved in the management of patients with cancer—is characterized by extended survival rates, diverse symptomology, and increasingly complex care trajectories. Today, cancer is one of the most challenging and costly conditions across the healthcare system.

Figure 1: Cancer Incidence, Survivorship and Spend are Rising[3]

A fundamental challenge in oncology lies in the complexity and heterogeneity of the disease. Cancer is not a single condition, but rather a group of hundreds of distinct diseases, each with unique molecular drivers, clinical behaviors, and treatment responses. This variability has contributed to persistent fragmentation across the care continuum, marked by episodic treatment models, inefficient delivery systems, and misaligned incentives among key stakeholders.

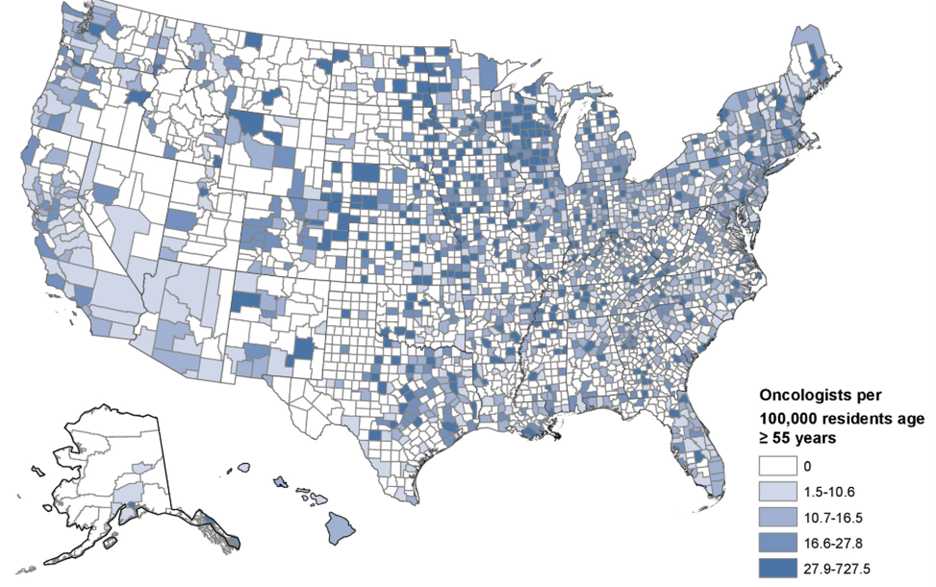

Compounding these challenges is an enduring disconnect between academia and the community, where the majority of care is delivered. Over half of U.S. counties lack a practicing oncologist[4], and survival rates still vary widely by geography, socioeconomic status, sex, and site of care[5]. Further, more than half of cancer-related emergency department visits in the U.S. are considered preventable[6], underscoring the need for integrated care teams and stronger adherence to evidence-based clinical guidelines. Together, these challenges highlight the urgent need—and clear opportunity—for scalable solutions that close gaps in access, coordination, and quality across the cancer care continuum.

Figure 2: Oncologists Per 100,000 Residents Age ≥55 Years in the U.S.[4]

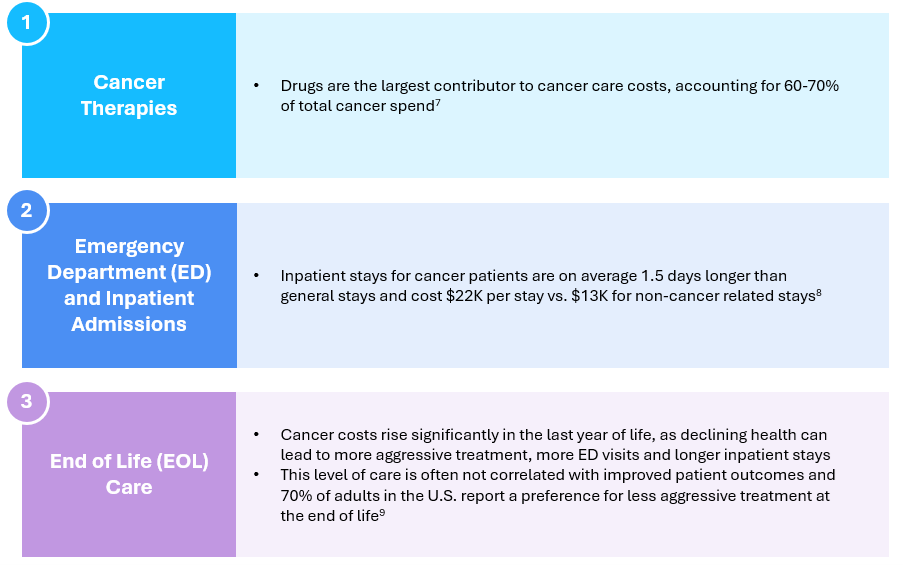

Why Is Cancer So Expensive? A Quick Look at the Drivers

Cancer therapies remain the single largest driver of oncology-related costs, accounting for an estimated 60–70% of total cancer spending[7]. Additionally, emergency department visits and inpatient admissions represent substantial cost burdens, as hospital stays for cancer patients tend to be both longer and more resource-intensive than those for other conditions[8]. End-of-life care also contributes disproportionately to overall costs, with declining health often triggering aggressive interventions and frequent hospitalizations—despite limited impact on outcomes. Strikingly, 70% of adults in the U.S. report a preference for less intensive treatment at the end of life, highlighting a significant misalignment between care delivery and patient values[9].

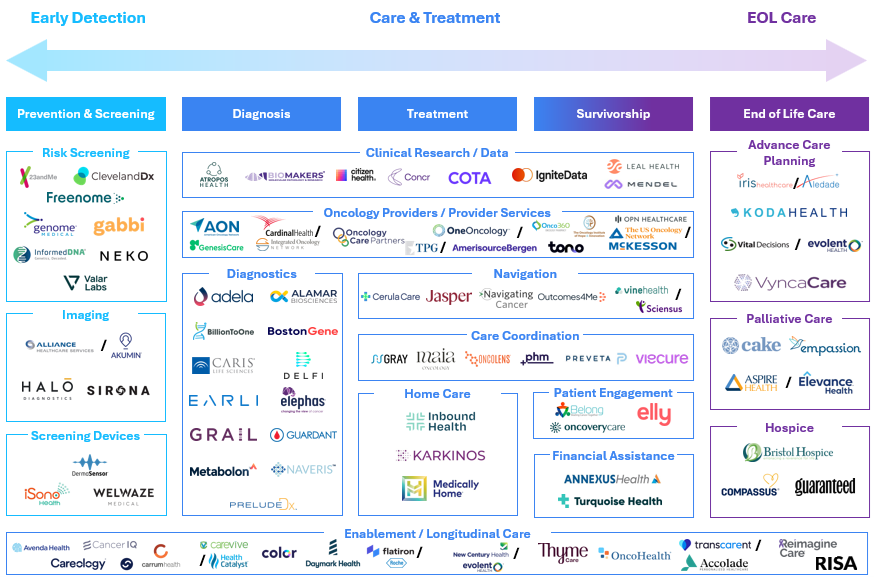

Shaping the Future of Oncology: Unlocking Value Across the Care Continuum

We believe transforming oncology requires a shift from managing cancer as a single episode to a patient-centered journey. By expanding the focus beyond the point of diagnosis, we unlock a future where care is more proactive, outcomes are measurably better, and value is created across the care continuum.

We predict the next generation of cancer care solutions will integrate multiple points along the patient journey, from early detection through end-of-life support. These companies will bridge long-standing disconnects between payers, providers, and patients—leveraging technology to streamline care, reduce costs, and deliver measurable impact. Finally, we expect cancer care to become more personalized, driven by advances in genomics, data analytics, and precision diagnostics that enable more tailored interventions across the patient journey.

Notable Themes Across the Care Continuum:

- Diagnostics: Although we view diagnostics as a distinct vertical—and therefore do not explore diagnostics-focused themes in this publication—we recognize that next-generation diagnostics and screening tools will be foundational to the future of cancer care. These innovations hold transformative potential to drive earlier detection and enable more precise, personalized treatment. Detecting cancer early remains one of the most powerful levers for improving outcomes.

- Oncology Providers & Services: Scaled community oncology networks—affiliated practices delivering cancer care outside of major medical centers—remain strategic acquisition targets for distributors. These networks offer a pathway for distributors to secure downstream demand for drugs and services, deepen relationships with high-prescribing providers, and gain strategic access to the point of care—especially in a market increasingly shifting toward value-based, decentralized, and outpatient cancer care. These networks offer consistent patient volume, prescribing influence, and operational scale, making them attractive assets to enhance margin, control distribution channels, and strengthen competitive positioning in oncology. Notable recent transactions include McKesson’s $2.5B acquisition of Florida Cancer Specialists and Cardinal Health’s $1.1B acquisition of Integrated Oncology Network.

- Enablement & Longitudinal Care: Companies that are either enabling the transition to Value-Based Care (VBC) or integrating services across the cancer care continuum have continued to attract investment and strategic interest. A notable recent example includes Thyme Care, which closed a $95MM round in July 2024 with participation from Concord Health Partners, CVS Health Ventures, Town Hall Ventures, a16z Bio + Health, Foresite Capital, and other insiders. Thyme Care partners with payers and providers to support patients across the cancer journey—improving outcomes and lowering costs through proactive engagement, care coordination, and analytics-driven interventions. As the market matures, we expect more companies to evolve beyond narrow point solutions toward more holistic, longitudinal approaches that deliver value across the full spectrum of care.

- End of Life (EOL) Care: Integrated palliative and advance care planning align treatment with patient goals, reducing unnecessary hospitalizations and costs while improving quality of life. The acquisitions of Vital Decisions, Iris Healthcare, and Aspire Health underscore the strategic value of tech-enabled solutions aimed at reducing avoidable or unwanted interventions at the end of life.

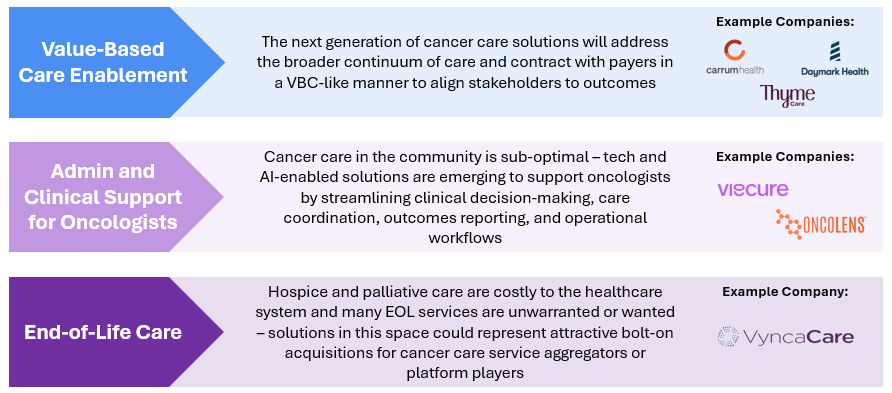

Business Models We Are Monitoring:

- Value-Based Care (VBC) Enablement:

- Problem: Cancer care remains fragmented, expensive, and often misaligned with patient outcomes. Fee-for-service models incentivize volume over value, leading to inconsistent care quality, poor care coordination, and rising costs.

- Solution: Providers and enablement partners that contract with payers in a VBC-like manner to align stakeholders to outcomes. For organizations assuming full financial risk, scale and operational sophistication are essential—enabling them to absorb actuarial risk, manage population health effectively, and demonstrate measurable value across patient populations.

- Examples:

- Thyme Care is an oncology-focused VBC enablement company that partners with health plans, employers, and risk-bearing providers to improve care quality, enhance patient outcomes, and lower the total cost of care. Thyme’s model combines virtual care navigation, data-driven insights, and proactive symptom management to support patients across the cancer journey.

- Carrum Health delivers a comprehensive, value-based oncology solution that connects patients to high-quality, evidence-based cancer care while controlling costs. The company partners with employers and health plans to offer access to a rigorously vetted network of Centers of Excellence (COEs), ensuring patients receive guideline-concordant care from top-performing providers across nearly all cancer types.

- Daymark Health is a cancer care company that collaborates with health plans to deliver in-home and virtual supportive services to patients with cancer. Working alongside a patient’s existing oncologist, Daymark provides wraparound care—including symptom management, psychosocial support, and care coordination—to improve patient experience and reduce avoidable acute care utilization.

- Administrative and Clinical Support for Oncologists:

- Problem: Oncologists today are battling more than just cancer itself. Workforce shortages, increasing administrative demands, and the rapid pace of scientific advancement make it difficult for providers to consistently operate at the top of their license. These pressures contribute to clinician burnout, fragmented care, and variable adherence to evolving clinical guidelines.

- Solution: Technology- and AI-enabled platforms are emerging to support oncologists by streamlining care coordination, outcomes reporting, operational workflows, and, in some cases, clinical decision-making. These tools help reduce administrative burden and enable more efficient, high-quality care delivery. Scalable business models in this space often require selling not only to health systems, but also to payers or life sciences organizations seeking data insights and workflow integration.

- Examples:

- Viecure provides an AI-powered clinical intelligence platform designed for community oncology practices. Viecure’s solution includes a smart electronic medical record system and decision support tools that guide treatment planning from diagnosis through follow-up, enabling more precise, evidence-based care at scale.

- OncoLens offers an AI-enabled platform that improves data interoperability and coordination across oncology care teams. It supports clinicians, researchers, and administrators with actionable insights to drive high-quality, connected cancer care. The platform also partners with life sciences companies to enable real-time patient-trial matching, accelerate clinical trial enrollment, and generate real-world evidence from community oncology settings.

- EOL Care and Advance Care Planning:

- Problem: Hospice and palliative care represent significant costs to the healthcare system, yet many EOL services are either medically unnecessary or misaligned with patient preferences. The lack of early, structured advance care planning often leads to aggressive interventions that do not improve quality of life and may run counter to patient goals.

- Solution: Tech-enabled solutions that incorporate palliative care and advance care planning earlier in the patient journey can reduce inappropriate hospital admissions, lower overall costs, and improve the management of physical and psychosocial symptoms. By aligning care with patient values and delivering support in less intensive settings, these solutions enhance both patient experience and system efficiency. We believe these solutions also represent attractive bolt-on acquisitions for cancer care service aggregators or platform players seeking to expand into supportive and longitudinal care.

- Examples:

- Vynca is a healthcare services and software company that provides advance care planning and palliative care through a hybrid clinical model combining in-person and virtual visits. Vynca’s approach helps reduce avoidable hospital admissions and supports patients in receiving goal-concordant care in the comfort of their homes.

- Vital Decisions, acquired by Evolent Health in 2021, offers personalized, telehealth-based advance care planning and decision support services. The platform engages patients with serious illnesses to ensure their care preferences are documented and respected, resulting in improved alignment with goals of care and fewer unwanted interventions.

Looking Ahead: A Blueprint for the Future:

Cancer care is entering a period of transformation—fueled by scientific progress and the breakdown of today’s fragmented, fee-for-service model. With millions of new diagnoses each year in the U.S. alone, the need for a more proactive, coordinated, and patient-centered approach to oncology has never been more urgent. As we look ahead, expect to see:

- Advancements in early detection and monitoring of high-risk patients

- Task reallocation from oncologists to AI-enabled solutions that support administrative tasks, care management and clinical decision-making

- Tech-enabled solutions to address care deserts in rural and community settings

- A stronger focus on proactive, personalized support across the cancer care continuum

- Greater adoption of value-based payment models among providers

- The emergence of new third-party organizations to operationalize value-based payment models

- Increased partnership with high-value cancer providers (i.e., centers of excellence) to better manage unpredictable costs

- Expanded behavioral health services in oncology to address the emotional, financial, and familial impact of cancer

[1] Mortality in the United States. Centers for Disease Control and Prevention and National Center for Health Statistics. 2022.

[2] World Health Organization. Global cancer burden growing amidst mounting need for services. 2024.

[3] 4 Predictions for Cancer Care in 2030. Advisory Board. Paul et al.

[4] Laura A. Levit et al. Closing the Rural Cancer Care Gap: Three Institutional Approaches. JCO Oncol Pract 16, 422-430(2020). DOI:10.1200/OP.20.00174

[5] Jemal, A., Murray, T., Samuels, A., Ghafoor, A., Ward, E., & Thun, M. J. (2004). Cancer statistics, 2003. CA: A Cancer Journal for Clinicians, 54(2), 78–93. https://doi.org/10.3322/canjclin.54.2.78

[6] lishahi Tabriz A, Turner K, Hong Y, Gheytasvand S, Powers BD, Elston Lafata J. Trends and Characteristics of Potentially Preventable Emergency Department Visits Among Patients With Cancer in the US. JAMA Netw Open. 2023;6(1):e2250423. doi:10.1001/jamanetworkopen.2022.50423

[7] Morse, E., Stanojev, L., Bahl, A., Huynh, D., Raghavan, A., & Herrin, J. (2023). Reducing preventable emergency department visits for patients with cancer: A multi-site payer–provider collaboration. Journal of Oncology Practice, 19(11_suppl), Abstract 69. https://doi.org/10.1200/OP.2023.19.11_suppl.69

[8] McDermott, K. W., & Roemer, M. (2021). Cancer-related hospitalizations for adults, 2017 (HCUP Statistical Brief #270). Agency for Healthcare Research and Quality. https://hcup-us.ahrq.gov/reports/statbriefs/sb270-Cancer-Hospitalizations-Adults-2017.pdf

[9] Schulman, K. A. (2023, July 12). End-of-life values and value-based care. The American Journal of Managed Care. https://www.ajmc.com/view/end-of-life-values-and-value-based-care

[10] MobiHealthNews. “The Future of Digital Cancer Care.” December 2, 2022. https://www.mobihealthnews.com/news/contributed-future-digital-cancer-care.