Revelation Partners is commonly asked what our typical discount is. There is no “typical” discount, nor is discount a key driver of pricing. We have closed transactions at a premium to recent marks, and we have also closed transactions at discounts >50%. Discounts in secondary market transactions are not inputs but rather outputs of a deal underwritten from the bottom up.

Beyond the company fundamentals, we must understand the cap table and shareholder rights. Even when there is alignment regarding a company’s projections and valuation, capital structure nuances can result in significant pricing differences by share class, leading to surprising headline discounts. Shareholder rights can sometimes be a bigger value driver than a company’s fundamentals. We believe the significance of these rights will become evident as investors increasingly seek liquidity, given the capital flowing into private markets, which has complicated and expanded cap tables, coupled with the rise of structured equity.

Revelation Partners has significant experience navigating the details of capital structures and ultimately pricing a wide range of securities. We want to share perspectives based on our experience to bring transparency to the sometimes complicated and perceived opaque prices and discounts, and ultimately support secondary liquidity.

Overview of Private Market Cap Tables and Rights

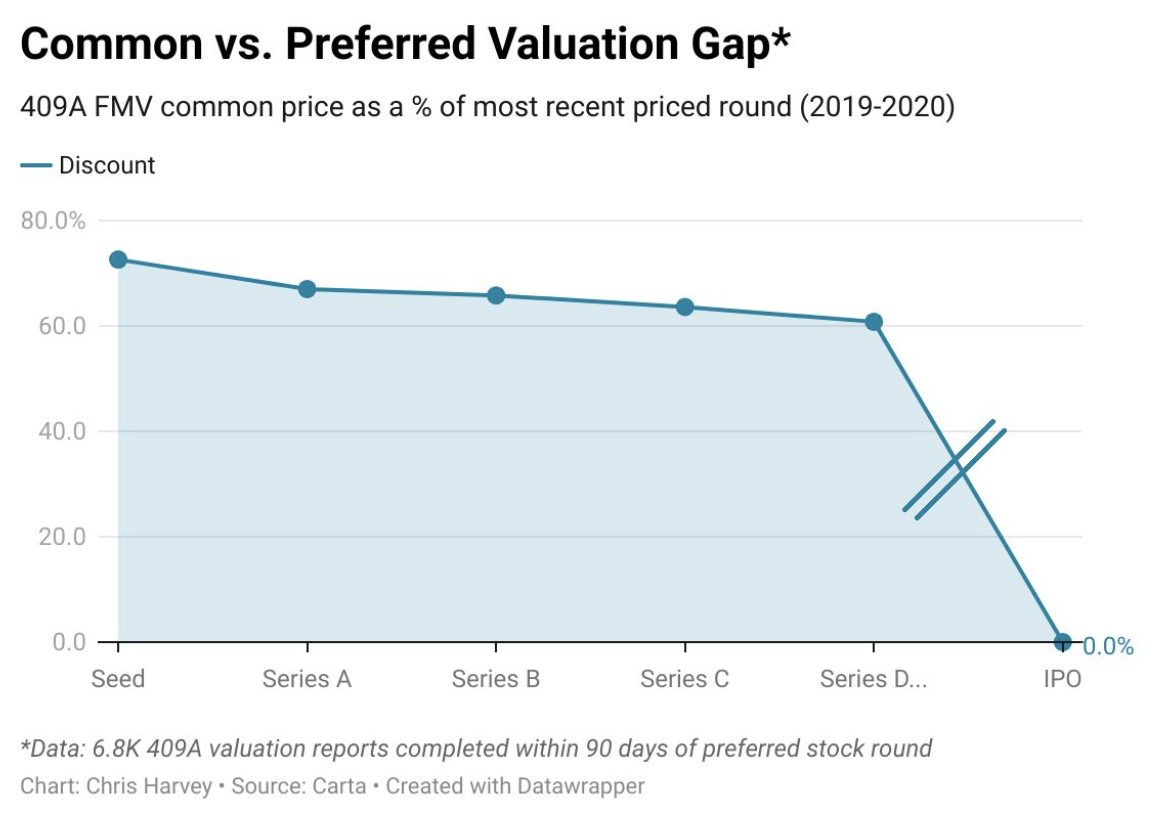

Cap tables can be far more complicated in private markets versus public markets, where all equity typically has the same economic rights. In private markets, however, each class of equity typically has different economic rights, creating a “waterfall” mechanism through which equity holders are paid out. Rights across share classes can differ materially depending on the circumstances of the specific round. Examples of these rights include seniority, liquidation preference, ratchets, and others. These rights can have significant economic value, particularly in downside scenarios, ultimately impacting other shares classes and creating significant divergences in prices by share classes. This helps explain the pricing of common shares in the 409A valuation, which is typically at a material discount to the most recent preferred round.

The Rapid Expansion of Private Market Cap Tables

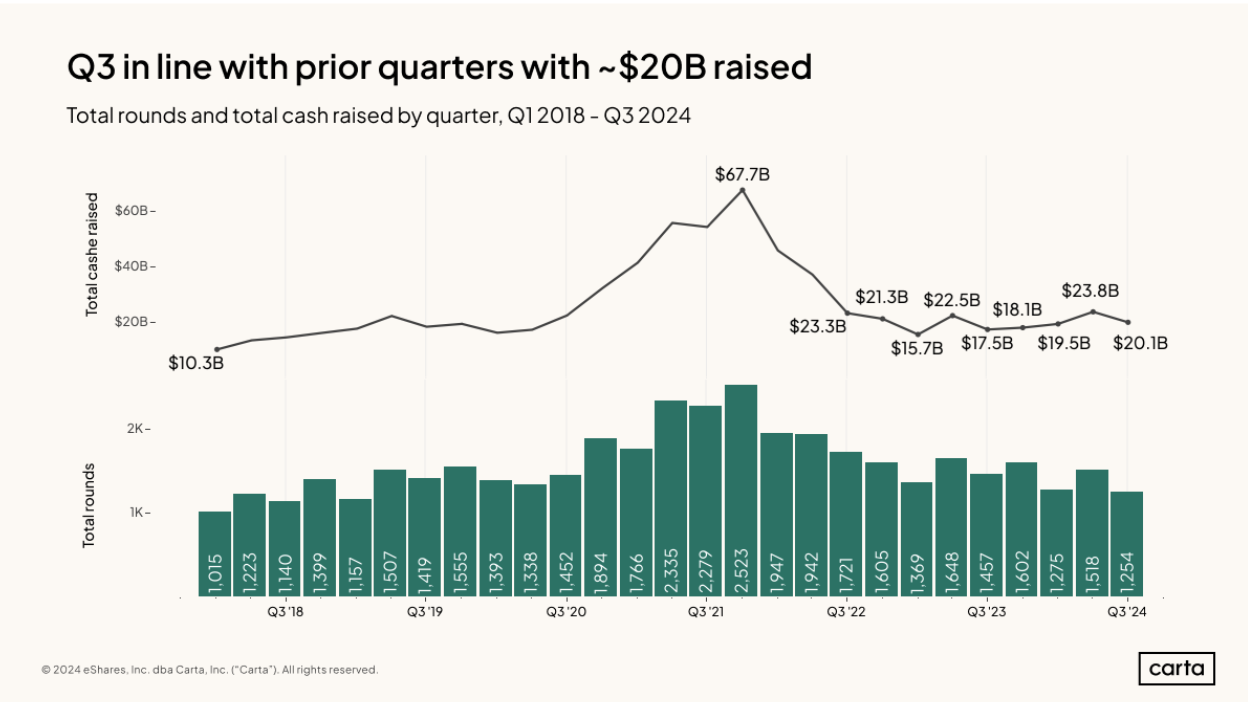

Cap table complexity has exploded over the past decade, driven by the expansion of private markets. Serial private market raisers are common; importantly, many did so at high valuations, ultimately raising a large quantum of capital. This is exemplified by the rapid growth in the number of unicorn deals, which grew significantly over the past decade, ultimately skyrocketing in 2021 and 2022. These rounds collectively pushed ~$850B onto companies’ cap tables.

Many companies took advantage of favorable market environments during 2021 – 2022 to raise large amounts of capital at high valuations. This large influx of cheap capital complicated cap tables by significantly increasing the preference and valuations that needed to be cleared at exit, magnifying the impacts of any decline in valuations.

The Downturn and Rationalization of Private Markets

Post-Covid, private market activity and valuations have faced significant headwinds. Outside of AI, which exploded post-Covid, rounds are taking longer to raise and are being completed at lower valuations, with down round frequency nearly double pre-Covid levels.

The downturn in capital markets has complicated cap table dynamics, investor marks, and future fundraising, as investor rights now kick in. Changes in enterprise value of companies do not translate linearly and uniformly to securities across the capital structure given how shareholder rights flow through the waterfall. We are seeing significant deltas between changes in equity valuations of companies, and changes in price per share of certain classes of stock for the same companies.

The Rise of Structured Capital

Structured capital has emerged as a key solution to address companies’ ongoing capital needs and complex cap tables. In simpler terms, structured capital refers to equity or, in some cases, debt, that includes rights that protect and/or magnify the returns of core underlying capital, often blending elements of both debt and equity. These rights include features such as liquidation preference, accruing dividends, and ratchets. Importantly, structured capital typically sits at the top of the capital stack, subordinating other investors’ economics and introducing new mechanics in the waterfall, ultimately creating more complexity in pricing and discounts in share classes.

We believe structured capital is not a temporary phenomenon but rather here to stay. In many parts of the market, there remains a significant supply/demand gap for traditional growth capital, and companies want to avoid the ripple effects of a down round. Funds ranging from Insight Partners to Coatue have raised dedicated vehicles focused on structured capital and will be active players for years to come. Longer term, overvaluation may persist, and beyond that, structured capital can perhaps better meet the needs of companies and investors, as exemplified by General Catalyst Customer Value Strategy. And strong fundraising activity and historical returns shows significant LP commitment to the space.

We envision cap tables becoming more complex in the future, and underwriting will require a detailed understanding of existing rights, and a perspective on future fundraises.

An Illustrative Example

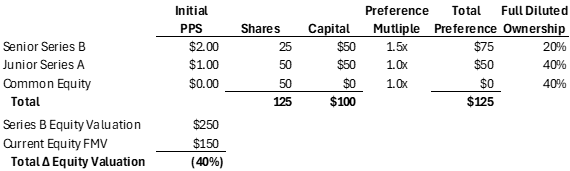

So, what happens when we combine these aforementioned factors, such as a down round and structured capital? Let’s look at a simplified example to illustrate the difficulties of suggesting “typical discounts” and the significant impact that structure has on pricing securities. Starting with an example cap table:

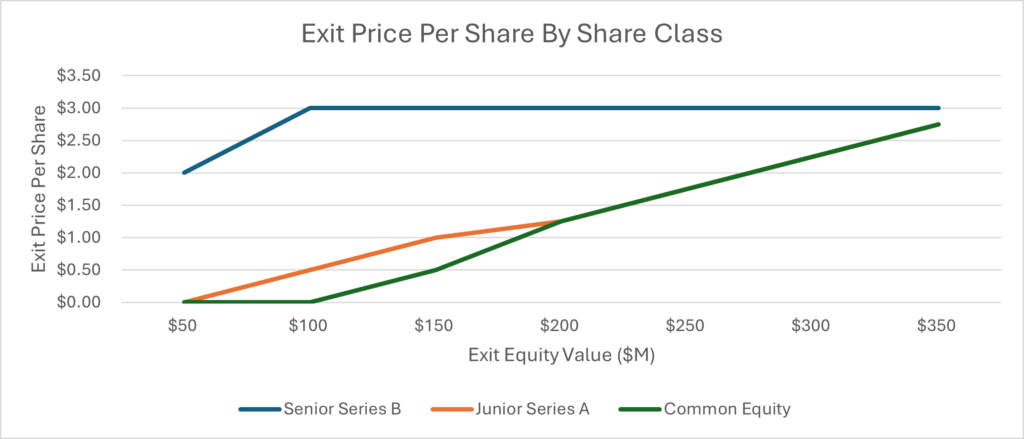

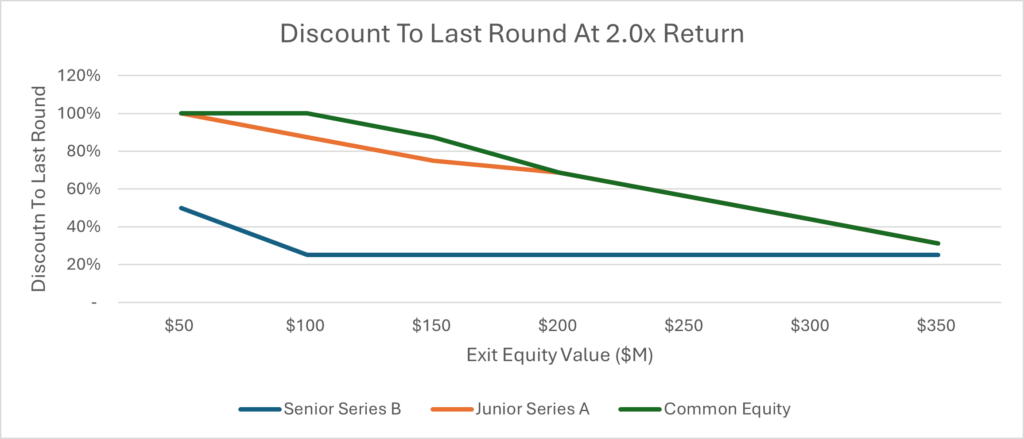

There are three layers of preference (we have seen >10!), and importantly, the senior most security has a 1.5x liquidation preference (we have seen up to 4x!). The company today is worth less than its last round (40%), another common dynamic in the private markets. Exit outcomes across a range of potential outcomes, and ultimately discounts, assuming a 2x investor hurdle, are:

There is no typical discount we could point to in pricing all these classes of securities, and even pointing to the current mark versus the last round would be misleading. Rather, we’d ask the following:

- What share class do you own?

- What are the rights of all share classes?

- What will the company exit at?

For the Senior Series B, its rights are the value driver, supporting a 25% discount in nearly all exit scenarios, which is materially better than both other classes across all exits. For the Series A and Common Equity, collective shareholder rights drive much larger discounts compared to the Series B, but fundamentals and exit valuation drive an even wider pricing range. Yet even that is nuanced, as at certain valuations, the Series A prices at a premium to Common given Series A preference.

This example just scratches the surface of the complexities of private market cap tables. Other rights, such as accruing dividends or ratchets, introduce new questions, such as when you expect to exit or what the terms of an interim financing would look like. However, these rights can be factored in and priced, and they should not be a barrier to liquidity. Revelation Partners is well-versed in this complexity and would welcome being a thought partner to anyone thinking through liquidity in a complicated cap table.