Historically, private companies have given employees equity incentives as an attractive supplement to cash compensation. However, employees have only been able to convert that paper wealth to cash through acquisition, IPO, or a secondary sale. In the past couple of years, liquidity events have tumbled. After a surge of 311 VC-backed IPOs in 2021, there were only 38 in 2022 and even fewer in 2023. Healthcare M&A also decreased by 30% in 2022 and fell again this year. This liquidity “drought” has sent reverberations through the market for talent and has increased the reliance on secondary sales as a liquidity channel for employees.

Take this example:

Companies Y and Z both make healthcare widgets and have similar commercialization trajectories, but Y is one year ahead of Z in its growth curve. In 2021, the CEO of Y was given the choice to go public and pulled the trigger. Early employees happily cashed out. Y’s founder was even able to take some chips off the table.

In 2022, the CEO of Z was given the same choice but stayed private. Fast-forward two years, and the window for IPOs remains shut. The employees of Z are left without traditional forms of liquidity and are seeking the promised fruits for their efforts.

The employees of Z are not alone. Across the larger economy, decision-makers at companies like Z are facing a paradox where employee expectations for liquidity are increasing at the same time as traditional liquidity events such as IPO or an M&A transaction have dried up. Morgan Stanley at Work recently surveyed 311 private company decision-makers who currently offer an equity plan and discovered that the issue has been pulled into the limelight:

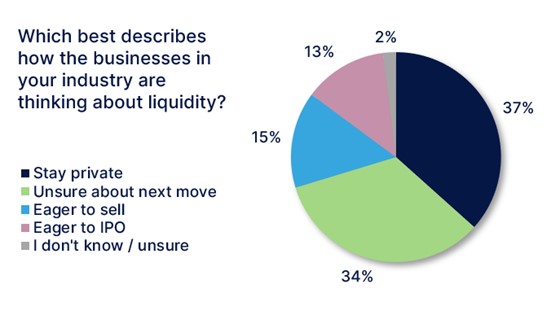

- 37% of private company decision makers report that their companies are staying private longer than originally planned, and 34% are unsure or questioning next steps.

- 59% report increased pressure to hold a liquidity event.

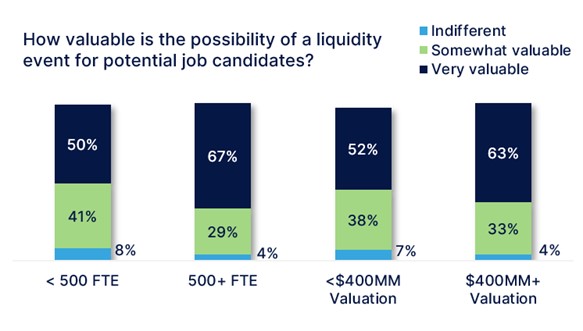

- 73% state that equity, in general, has become more valuable to prospective talent than years before.

- 93% report that the company’s ability and/or possibility of having a liquidity event is valuable to a prospect’s decision when considering a job offer.

In the absence of IPOs, M&A, SPACs and direct listings, secondary liquidity has become a release valve. Direct secondaries are expected to reach $85 billion of volume in 2023, up from $12 billion in 2012 and $60 billion in 2021. These secondary offerings have traditionally taken on several forms:

- Tender offer: a structured liquidity event that allows a set of eligible shareholders to sell their shares to an investor, a group of investors or back to the company at a predetermined price.

- Direct secondary sales: a shareholder in a company sells their shares to another investor.

- Company sponsored program for shareholders and employees to participate in secondary transactions.

Revelation Partners has 10 years of experience helping companies navigate direct secondaries. If you’re a decision-maker at a private healthcare company dealing with this dilemma, we would be happy to start the dialogue. We have a variety of tools in our kit, from helping structure employee liquidity programs, founder liquidity, angel investor liquidity, and more. In the meantime, we’ve published a few whitepapers to help give you a head start:

- Tender Offers: A Guide for Late-Stage Private Companies

- Stock Option Liquidity: A Guide for Private Company Employees

- Accessing Liquidity in an Illiquid Market

Source: Morgan Stanley At Work, Liquidity Trends Report 2023: Perspectives from Private Company Leaders