2025 marked a clear inflection point for healthcare investing—not because capital fully returned, but because discipline did. Liquidity remained constrained, fundraising became more selective, and exit pathways narrowed, forcing both investors and operators to adapt. As a result, healthcare companies are now being built, financed, and evaluated under a far more rigorous set of expectations than in prior cycles.

Against this backdrop, five structural forces defined the healthcare market in 2025. Together, they explain how capital is being deployed today—and where opportunity and risk are most likely to emerge in 2026.

1. Liquidity Is the Constraint

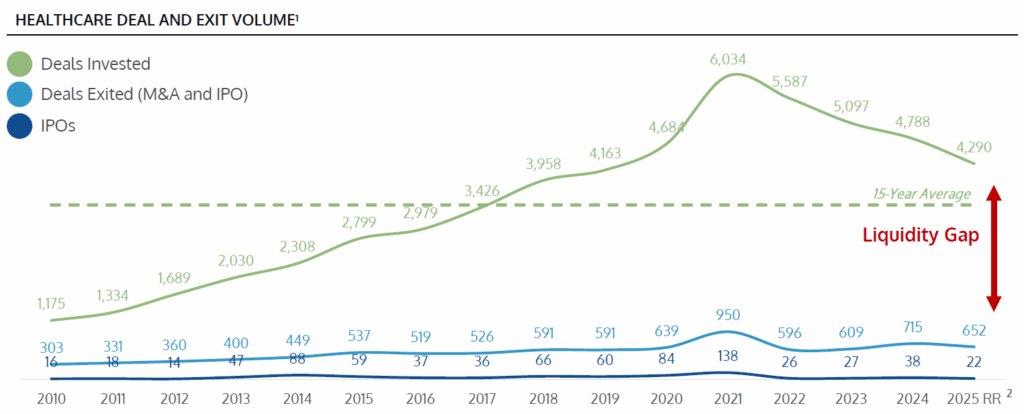

2025 was an active year for healthcare investing. While headlines suggest an opening IPO window and increased M&A activity, much of that momentum has yet to meaningfully reach healthcare. More than $1 trillion has been invested in private healthcare companies over the past 15 years, yet exit activity over that period has remained relatively flat.

The result is a persistent liquidity constraint across healthcare venture and private equity. For 2010–2023 vintage funds alone, more than $800 billion of unrealized value remains trapped in private healthcare portfolios.

(1) Represents 2010-2023 unrealized value, Pitchbook, Cambridge Associates Venture Capital Benchmarks as of Q1 2025. Invested capital used as a proxy for value deployed in each vintage.

This liquidity imbalance is now influencing fund strategy, portfolio construction, and exit decision-making across healthcare. The number one priority for fund managers we speak to is generating DPI to return capital to LPs and support future fundraising. That said, 2025 was not a standstill. We saw continued structural innovation in liquidity solutions, including more bespoke continuation vehicles, NAV loans, preferred equity structures, and minority recapitalizations—tools designed to support strong companies without forcing premature exits. Ultimately, it’s both GPs and their underlying LPs who benefit from exploring these innovative liquidity solutions.

Some of our thoughts on this topic from 2025

What to watch in 2026:

Expect a more active secondary market and increasingly creative liquidity solutions. We also anticipate venture fund managers will become far more proactive in pursuing secondary transactions as part of portfolio management and fund-level liquidity planning.

2. Capital Is Selective

Against a backdrop of constrained liquidity, it remains a challenging fundraising environment for companies. The bar continues to rise as investors prioritize de-risked assets, proven business models, meaningful revenue traction, and a clear path to profitability. In many cases, access to capital comes with punitive structural terms.

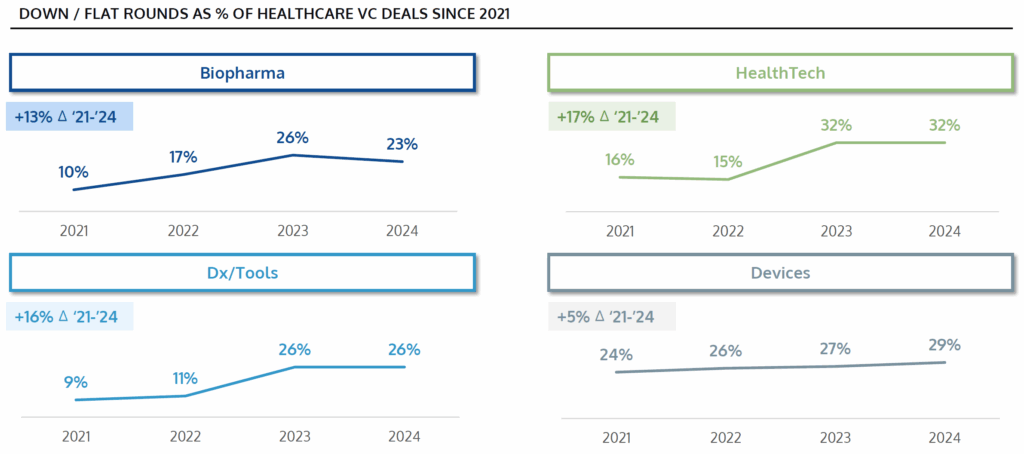

We are seeing a tale of two cities in healthcare. A very select group of high-quality companies continues to raise sizable rounds at step-up valuations, while for most others the best outcome is a flat or down round.

SVB data shows that the share of flat and down rounds for venture-backed healthcare companies increased from 2021 to 2024 across all sub-sectors. While 2025 data is not yet available, our portfolio experience and current deal flow suggest this trend has only intensified. We are also increasingly seeing punitive pay-to-play structures that can significantly dilute—or effectively wipe out—existing shareholders who do not participate pro rata.

Some of our thoughts on this topic from 2025

What to watch in 2026:

A gradual return towards fundraising equilibrium as investors move off the sidelines to deploy dry powder, while the overhang of high-valuation, COVID-era companies fades following recapitalizations completed over the past 12–24 months.

3. Exits Have Reset

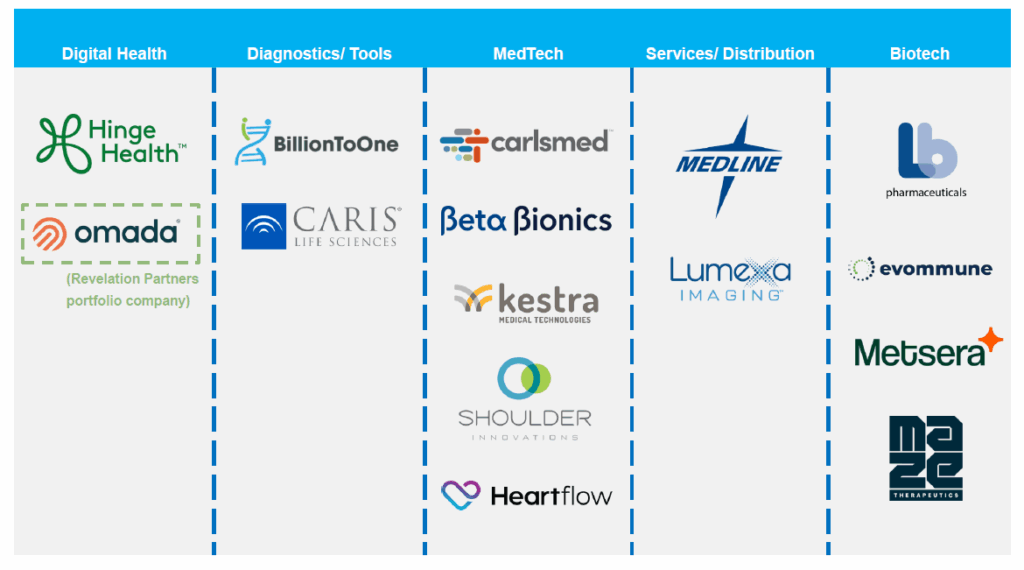

After years of stagnation, the IPO window cautiously reopened in 2025—but only for companies that met a very high bar. Successful issuers shared a common set of characteristics:

- For commercial stage businesses, predictable growth and scale (including near-term path to profitability)

- For medtech and biotech, de-risked portfolios from a clinical, regulatory, and reimbursement perspective

- Clear category leadership

- A credible valuation reset aligned with public-market expectations

Healthcare companies that did go public faced intense scrutiny around operating performance and forward guidance. Public investors rewarded scale, operational discipline, and revenue visibility, while penalizing volatility, complexity, or growth lacking a clear economic foundation.

Key 2025 Healthcare IPOs by Sector

At the same time, private equity has become an increasingly important—and often the most reliable—exit path in healthcare. We saw this across numerous transactions including with our portfolio company Arcadia that sold to Nordic Capital. PE firms value the sector’s recession-resistant characteristics and have stepped in amid a prolonged pullback from strategic acquirers and a limited IPO window. For many healthcare companies, private equity – not the public markets or strategics – is now the base case exit. This shift has meaningful implications for venture-backed companies: operating models must increasingly emphasize profitability, predictable cash flows, and operational rigor, as private equity rises as a likely buyer for many scaled healthcare businesses.

What to watch in 2026:

More companies will test the IPO waters, but the bar will remain high—particularly given the mixed aftermarket performance of the 2025 IPO cohort. We expect private equity to play an even more central role as an acquirer of healthcare businesses, further reinforcing the importance of building companies with profitability, resilience, and cash-flow visibility at their core.

4. Regulation Remains a Differentiator

The healthcare regulatory environment is always evolving, and 2025 was no exception. Policy changes, reimbursement shifts, and regulatory enforcement continue to shape the sector, redistributing value across business models and subsectors. This dynamic is neither new nor inherently negative—regulation in healthcare consistently creates winners and losers. For investors and operators, the focus is less on predicting outcomes and more on underwriting durability while avoiding binary regulatory exposure.

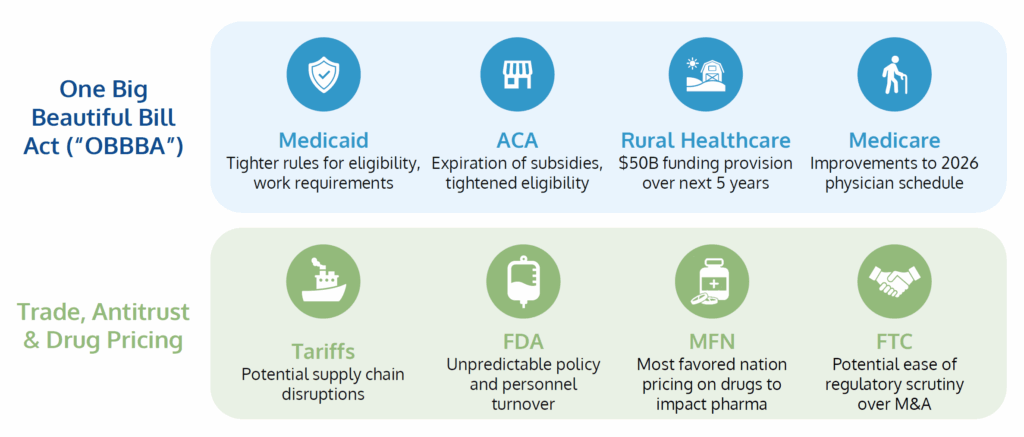

Healthcare Policy and Regulatory Trends in 2026

A central policy development in 2025 was the passage of the “One Big Beautiful Bill,” a sweeping piece of legislation that reallocates healthcare spending priorities. While broad in scope, its most meaningful impact is concentrated on Medicaid, which faces the largest relative funding reductions over the next decade. These cuts reinforce a long-standing reality: many Medicaid-exposed business models face persistent funding pressure, complex state-level variability, and structurally weaker economics. Meanwhile, the expiration of enhanced premium subsidies for the Affordable Care Act (ACA) is expected to increase the uninsured rate and put pressure on businesses with exposure to this patient population.

Other regulatory forces have also garnered significant headlines but, to date, have not generated material structural impact. Trade policy and tariffs present potential supply-chain friction—particularly for medtech and life sciences—but effects have been uneven and largely manageable for companies with domestic manufacturing footprints and healthy margins. Similarly, drug pricing rhetoric has outpaced policy action, with implemented measures remaining narrow in scope; however, drug affordability remains a stated priority of the Administration, suggesting this area warrants close monitoring. Ongoing policy direction shifts and personnel turnover at the Food and Drug Administration (FDA) have introduced near-term uncertainty around review timelines, though these disruptions have not yet translated into widespread operational impact, and the timing of a return to stability remains unclear. Finally, antitrust enforcement has begun to ease, with early signals pointing toward a more permissive posture on healthcare M&A.

What to watch in 2026:

Regulatory noise is likely to persist into 2026, particularly around reimbursement, reinforcing the importance of diversified payer mixes. While FDA unpredictability is expected to continue in the near term, antitrust enforcement appears to be easing, potentially unlocking incremental healthcare M&A activity. The key question for 2026 is whether today’s headline-driven regulatory dynamics—spanning drug pricing, FDA review capacity and timelines, trade enforcement, and antitrust policy—translate into more durable policy shifts. As always, success will favor companies and investors focused on resilience, diversification, and long-term economic fundamentals.

5. AI and GLP-1s: From Hype to Necessity

Two forces shaped healthcare discourse in 2025—artificial intelligence and GLP-1s. While both topics are widely covered by other investors, any credible review of the year would be incomplete without acknowledging their growing impact. More importantly, 2025 marked a shift from experimentation and speculation toward real-world application. In both cases, fundamentals—not hype—are increasingly separating winners.

AI reached a clear inflection point in healthcare this year, moving from broad experimentation to practical deployment. About two-thirds of US physicians are now using AI tools in clinical practice, up nearly 80% in just two years [add source], and over 70% of providers and payors report having an AI strategy in place or in development.[1] The most durable progress has occurred in high-volume, rules-based workflows where automation delivers tangible operational benefit. This includes areas such as revenue cycle management, utilization management, coding, chart review, diagnostics, and clinical trial enablement—where AI is becoming embedded into core infrastructure rather than layered on top. While investor interest remains high, relatively few companies have demonstrated true scale, defensible integration, and sustainable economics—an important distinction as competition intensifies.

Some of our thoughts on this topic from 2025

At the same time, GLP-1s have rapidly emerged as one of the most consequential drug classes in modern medicine, accelerating a shift toward longitudinal management of chronic metabolic disease. Beyond the drugs themselves, we have seen the surge of integrated care models, payer-aligned services, and technology-enabled platforms that improve access, adherence, and long-term engagement. Ultimately, the long-term impact of GLP-1 therapies will be defined by whether they deliver sustained improvements in clinical outcomes, not just short-term weight loss or increased utilization. Recent policy actions expanding coverage are expected to further increase utilization beginning in 2026, with downstream effects on providers, services, and existing care pathways still coming into focus.

As with AI, the most compelling opportunities lie in how GLP-1s are incorporated into broader care models rather than in standalone exposure to the therapy.

Some of our thoughts on this topic from 2025

What to watch in 2026:

Across both AI and GLP-1–enabled care, the next phase will be defined by proven ROI and increased differentiation. Undifferentiated approaches will struggle, while companies that demonstrate operational rigor, workflow integration, and payer alignment will increasingly separate from the pack. These forces will continue to reshape healthcare business models—not as panaceas, but as structural shifts reinforcing the industry’s broader return to discipline.

Conclusion

Across liquidity, fundraising, exits, regulation, and innovation, 2025 reinforced a consistent lesson: durable healthcare businesses win. Companies built on proven business models, strong unit economics, diversified exposure, and operational rigor are best positioned to navigate market cycles—regardless of volatility.

Looking ahead to 2026, we expect continued selectivity in capital allocation, ongoing regulatory and reimbursement noise, and accelerating adoption of technologies and care models with clear ROI and real-world impact. Liquidity solutions will grow more creative, private equity will remain a critical exit path, and structural forces such as AI and GLP-1s will continue to reshape—rather than rescue—healthcare business models. In this environment, lasting value will accrue not to novelty or leverage, but to discipline, execution, and durable economic fundamentals.

[1] McKinsey & Company. “Generative AI in healthcare: Current trends and future outlook.” March 26, 2025. https://www.mckinsey.com/industries/healthcare/our-insights/generative-ai-in-healthcare-current-trends-and-future-outlook.