Investment in digital behavioral health companies has surged in recent years, driven by rising demand and favorable regulatory changes. We define this sector as tech-enabled practices who offer therapy, psychiatry, substance use disorder (“SUD”), and other behavioral health services. Typically, these services are offered through a telehealth platform but may also include in-person sessions or digital therapeutics.

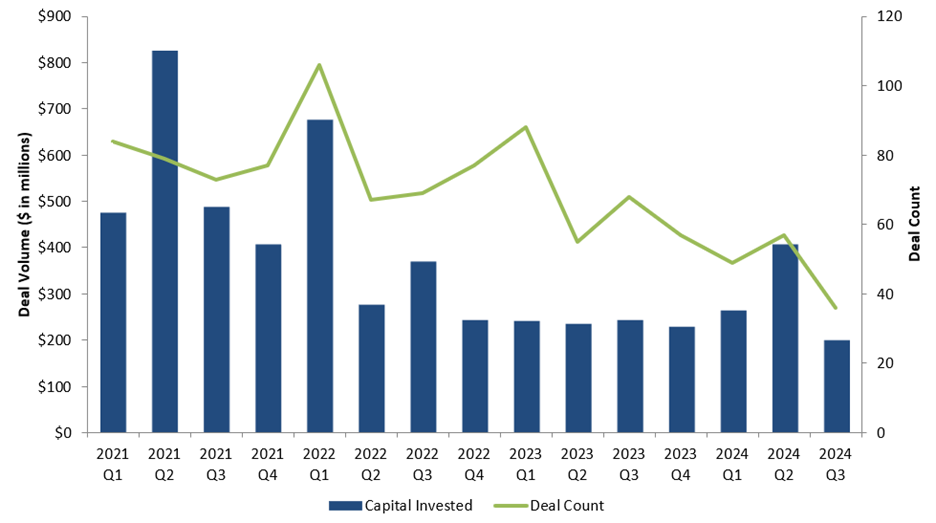

$7 billion has been invested over the last five years [1] and 142 deals funded year-to-date in 2024. Investment peaked at $2.2 billion in 2021, and LifeStance Health (NASDAQ: LFST) and Talkspace (NASDAQ: TALK) both went public – bringing digital behavioral health offerings into the public eye.

Behavioral Health Private Funding Activity:

Source: Pitchbook as of September 2024

While there remains a pervasive need for expanded behavioral health services leaving the sector ripe for investment, the competitive landscape has grown crowded. There are over 500 venture-backed behavioral health companies today.[2] To help navigate this competitive environment, we’ve sought to highlight the most attractive business models and attributes we’ve seen.

From 10,000 feet, we think companies must have a strong value proposition for payers, therapy providers, and patients. For payers, the number one problem to date has been accessing the fragmented population of ~650,000 therapists in the U.S.[3] Historically, therapists faced poor reimbursement rates, claim denials, and tedious billing processes – thus, cash pay practices became the norm. The Affordable Care Act and recent national legislative advancements have improved the coverage environment, but out-of-network care is still more than double the rate for mental health versus general medical care.[4] Therefore, companies with larger networks who can treat a larger patient population have been able to negotiate higher reimbursement rates.

Moving forward, scale will still be important, but there will be a greater focus on quality of outcomes. Companies who implement measurement-based care and track outcomes (e.g., improvement on PHQ-9 / GAD-7 scale, patient retention, etc.) will have more durable reimbursement in the long run.

For therapists, platforms must provide attractive compensation, alleviate back-office and administrative burdens, and bring in steady patient flow. For patients, they must expand access to care, streamline routes to specialized care, and enable reimbursement through insurance.

We are focused on behavioral health businesses that have proven unit economics, are scalable, have differentiated quality and outcomes, and have capital-efficient customer acquisition engines. We think these will be the most interesting assets in the public markets or to acquirers. Under this framework, here are a few business models we think are interesting:

- Supply aggregators

Select Examples:

Supply aggregators operate a three-sided marketplace connecting patients, payers, and therapists.

Their business model resembles an “Uber”-like platform – therapists are generally 1099 employees and can still operate their own private practice concurrently. As a result, joining a supply aggregator is a smaller commitment than joining a full-time practice and allows therapists to continue treating legacy patients. Therapists are paid attractively per visit. They no longer need to spend time and money acquiring patients or performing non-clinical administrative tasks such as billing and scheduling. The strong therapist value prop has helped these companies scale rapidly into the market.

Supply aggregators have also experienced meaningful traction with payers. They have scaled so quickly because they’ve solved the access problem well, and payers have been more willing to contract with them at premium rates.

While to date payers have been primarily focused on access, we expect they will begin to focus more on quality of outcomes moving forward. We believe one risk with the 1099 model is that it could lead to more difficulty controlling quality of outcomes versus W2 practices. Companies that will succeed in this category will need to prove that they can successfully implement measurement-based care tracks leading to positive outcomes despite a less hands-on approach.

2. Employer-focused digital practices

Select Examples:

This category of practices has been focused on integrating with self-insured employers, replacing traditional Employee Assistance Program (“EAP”) vendors.

Behavioral health spend has been pulled into the forefront of wellness spending for corporates. Despite 86% of U.S. employees facing at least one challenge in the past year,[5] only 33% received support. COVID-19 thankfully helped to de-stigmatize behavioral health treatment in the workplace, and employers have been quick to prioritize bringing on tech-enabled vendors to help close the gap.

Historically, EAP vendors provided more limited solutions at a lower cost to employers. In recent years, however, employers have been more willing to pay a higher price for vendors who have demonstrated superior quality and concierge-level support.

Although EAP sales cycles can be long, once they are won vendors get preferred access to large populations of patients at once. This equates to more capital efficient patient acquisition. Revenue is also stickier – we’ve seen business models in this space with both recurring (PMPM) and re-occurring utilization-based (FFS) revenue.

As the limited universe of corporates becomes more penetrated, we expect driving utilization within employee populations will become a bigger focus.

3. Specialty digital practices

Select Examples:

The final category is digital practices who specialize in a single treatment area (e.g., NOCD – OCD, Equip – eating disorders, Cortica – autism, etc.) or end market (e.g., Iris – community mental health centers or Talkiatry – psychiatry). These companies have carved out niches within the market that enhance the value prop for specialized therapists by using technology catered towards treating specific use cases.

By offering the #1 treatment option for specific patient populations, these companies have been able to acquire patients more effectively with increased web traffic and referrals through robust online patient communities. Payers are also often reimbursing at better rates given specialized therapists are scarce, and some conditions have specialized CPT codes.

Finally, we think these businesses deliver a clear strategic rationale for potential acquirers. Hiring and retaining specialized providers in this market is an attractive asset given they are scarce and, for many conditions, require additional licensing.

Conclusions

With a limited supply of therapists and overflowing demand, technology has accelerated progress towards solving the imbalance. Hundreds of companies have scaled quickly into the market, and we believe M&A and IPO activity will begin to ramp up meaningfully in suit. There will be multiple winners, but businesses with superior unit economics, capital efficient patient acquisition, and salient quality of care will rise above the rest.

Special thanks to Fred Lee and Rob Rein for their contributions to the market mapping and research supporting this post.

Footnotes:

[1] Pitchbook data; Note: Private companies filtered for the keywords “behavioral health,” “mental health,” “substance use disorder.”

[2] Pitchbook data.

[3] Bureau of Labor Statistics data.

[4] Kyanko KA, Curry LA, Busch SH. Out-of-network provider use more likely in mental health than general health care among privately insured. Med Care. 2013 Aug;51(8):699-705. doi: 10.1097/MLR.0b013e31829a4f73. PMID: 23774509; PMCID: PMC4707657.

[5] Lyra Health’s State of the Workforce Mental Health survey.