Healthcare insurers sit at the center of the U.S. healthcare system, controlling nearly 90 cents of every healthcare dollar[1]. Yet despite their scale and influence, the nation’s largest payers (e.g. Humana, CVS, UnitedHealthcare, etc.) are facing unprecedented pressure. Stock prices for the major insurers have dropped 15–55% since early 2023, even as the overall market has trended up and to the right[2]. Rising utilization, tighter reimbursement, and mounting regulatory headwinds are squeezing already thin margins, forcing payers to rethink their operating models.

For years, the strategy was vertical integration — buying providers, clinics, and ancillary service businesses in hopes of capturing more of the value chain. But execution has proven difficult. CVS’s bet on Oak Street (now hunting for a capital partner) and United’s integration of Amedisys (which required the divestiture of more than 160 facilities) underscore that these deals are proving harder to monetize than underwritten[3],[4]. As vertical integration has not generated real synergies and run into antitrust issues, payers have moved away from “owning everything” and are focused on organic growth and operational improvements. That new mindset has put technology at the center of the conversation. With few levers left to pull and the new advent of AI, insurers are investing in new tools that can upgrade their internal IT departments, help them capture revenue, contain medical costs, and streamline operations[5] (Figure 1).

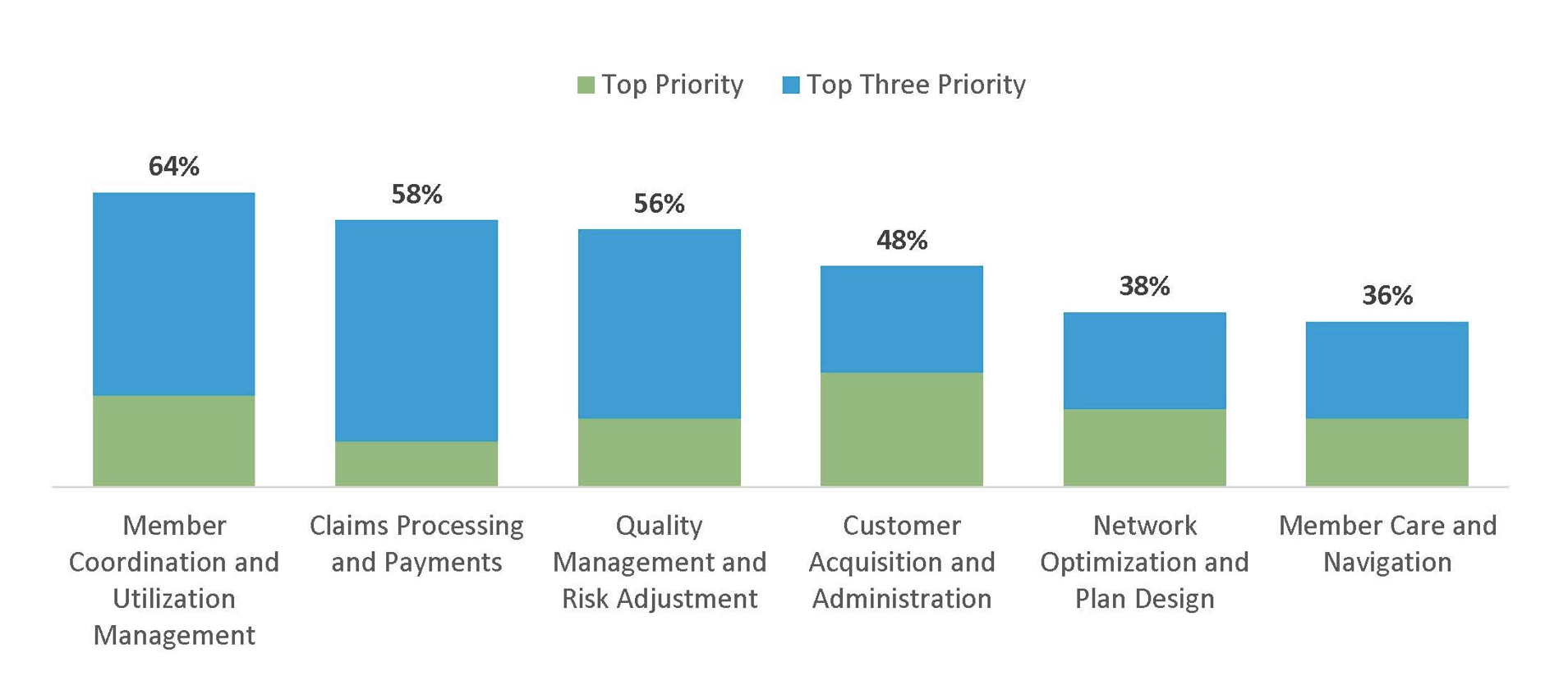

% of Payers Citing Top Software and Digital Technology Investment Priorities

The opportunity for entrepreneurs and investors to build new technology tools for payers is significant, and payers are interested in making that investment. While the payer IT market is concentrated in a few private equity owned highfliers (ie.Inovalon, Arcadia, Lyric, Healthedge, Datavant, etc.) and notoriously difficult to break into for new venture platforms, we believe the right companies can achieve durable growth, sticky integrations, and premium valuations.

As a firm, we have spent time understanding the payer IT landscape. In this blog post, we explore some of those findings including:

- What we think it takes to build a winning company in payer IT.

- What subcategories of the payer IT landscape are most attractive to invest in.

- What are some of the exciting companies we have seen in the space.

The Market Backdrop

To understand the present opportunity in Payer IT, it is important to understand the forces squeezing payers:

- High Utilization: Medicare Advantage beneficiaries are using more care than payers expected, driven by a growing base of beneficiaries, changing demographics (sicker patients), and remnants of a post-pandemic “catch-up.” This is driving elevated medical loss ratios and eroding margins.

- Reimbursement Headwinds: CMS’s v28 risk adjustment changes and STAR quality rating adjustments are cutting into Medicare Advantage premiums and bonus payments (see “Quality Management & Risk Adjustment” section below for some useful definitions).

- Changes in Eligibility: changes in ACA subsidies and new Medicaid work requirements introduced through the One Big Beautiful Bill (OBBB) are creating churn and increasing uninsured rates.

- Razor Thin Margins: With payers already operating at ~3% margins, even small shifts in cost or reimbursement have outsized impacts on earnings.

Payers are focused on technology as a key lever to defend profitability. With recent advancements in data, analytics, and interoperability tools—many of which are driven by AI—payers will need to make significant technology investments to stay above water.

Challenges for Payer IT Innovators

Breaking into the payer IT market is not for the faint of heart. A few structural hurdles make this one of the toughest corners of healthcare IT:

- Long Sales Cycles: Closing a deal with a national payer can take 12+ months — significantly longer than provider or employer channels.

- Concentrated End Market: Just 5–6 large payers dominate the U.S. market, creating customer concentration risk and limited early adoption opportunities. Adding to this, national payer adoption is key to demonstrate platform adoption and scalability.

- Scale as Table Stakes: Large PE-backed platforms and payer-owned incumbents set the standard; smaller entrants need to show scale quickly or risk being overlooked.

- Integration Burden: Payers rely on deeply embedded legacy systems; new solutions must integrate seamlessly into claims, EHR, and analytics infrastructure.

The implication is only companies with truly differentiated technology, proven ROI, and a strategy for scaling within a concentrated market will be able to break through.

What Makes a Winning Payer IT Company

- Advanced Technology: With entrenched incumbents, the only viable way for smaller entrants to compete is through step-change improvements in accuracy, speed, or automation. AI and modern data tools are reshaping payments, claims management, and prior authorization workflows — and payers are actively seeking partners who can deliver it.

- Direct and Clear ROI: Solutions must hit the categories that matter most — either driving topline revenue (ie. bending the curve in risk adjustment and quality) or reducing medical costs (ie. via improved payment integrity and utilization management). Without a clear ROI, payers will not buy.

- Asset-Light, Software-Driven Models: Scalable, capital-efficient platforms with recurring or transaction-based revenue models command higher multiples from investors. Payers are increasingly looking to bring software capabilities in house that integrate seamlessly into their systems vs outsourcing services to expensive third parties.

- Sticky Integrations: Products that embed deeply into payer systems (claims, EHR, care management) become indispensable, raising switching costs and increasing customer lifetime value.

Taken together, these attributes define the emerging winners in payer IT: companies that combine cutting-edge technology with demonstrable value creation in the categories payers care about most.

Spotlight on High-Priority Categories

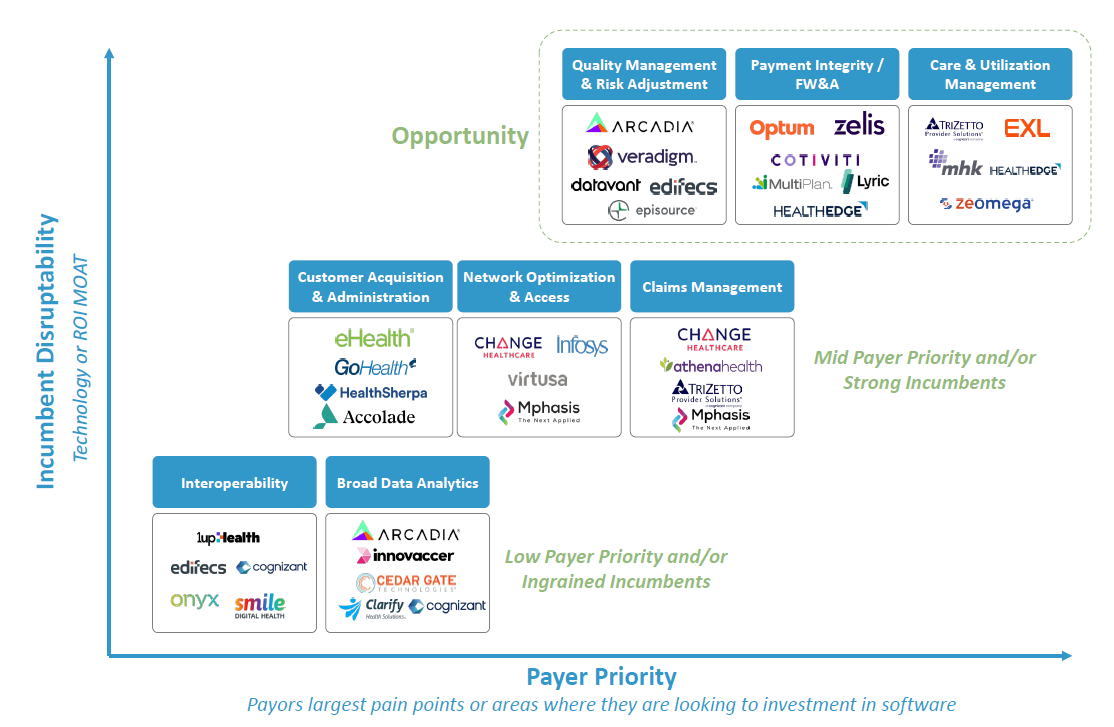

Based on our internal analysis of payer priorities and incumbent disruptability, three categories emerge as the most attractive:

- Quality Management & Risk Adjustment

- Payment Integrity

- Care Management & Utilization Management

Incumbent Landscape

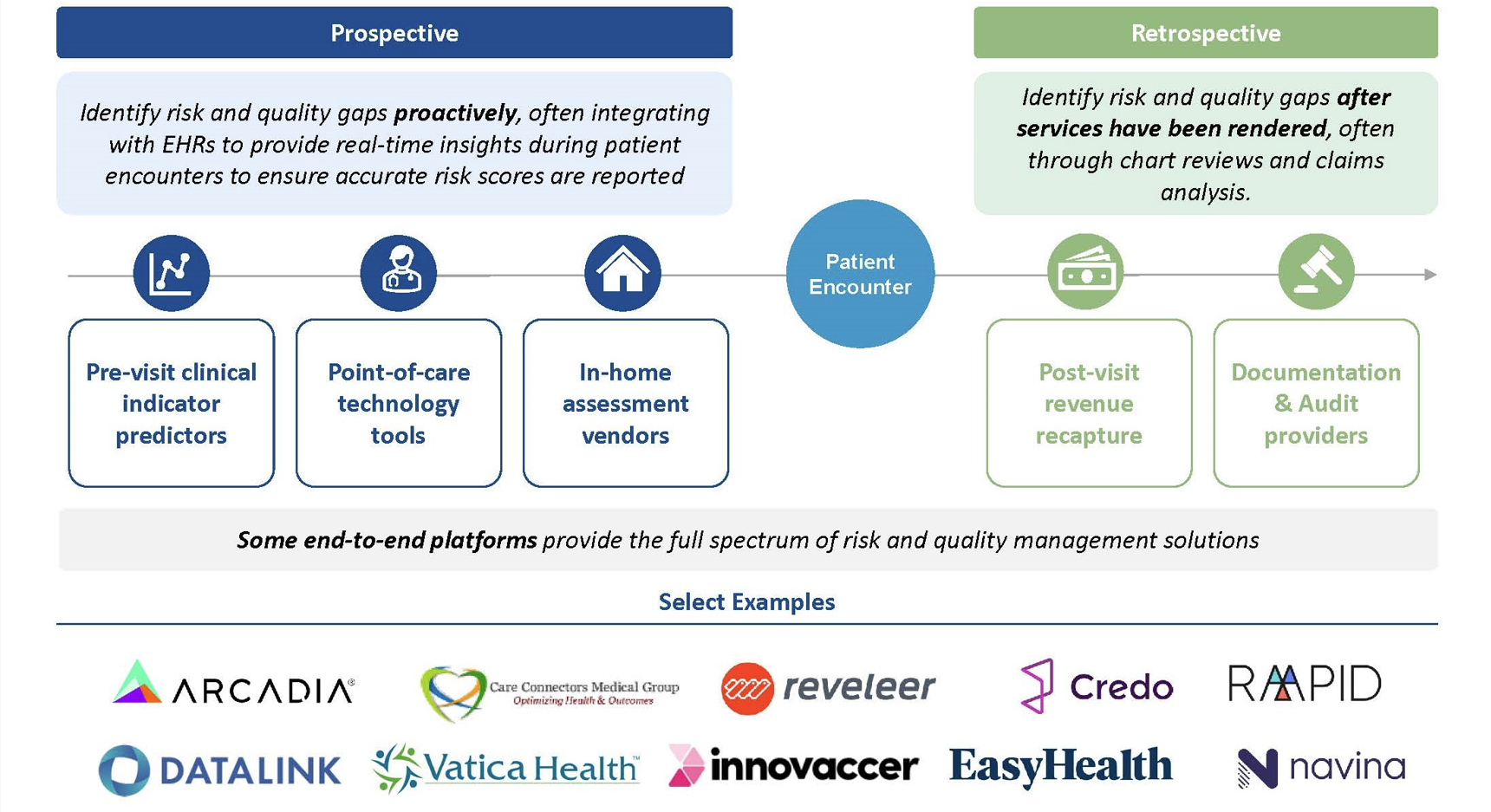

1. Quality Management & Risk Adjustment

- Description: Solutions for health plans to measure and report performance on quality of care (ie. gap identification and HEDIS metrics) and to identify and measure acuity risk levels of members (risk scores or risk adjustment factors).

Some definitions for those that are newer to the space:

Risk Score: measure of a member’s health condition to predict their cost of care. Assigned based on demographic information, health status, existing chronic conditions and disabilities.

- A patient with a higher risk score results in a higher baseline payment to the health plan covering their care. For example, an 85-year old male has a baseline score of 0.686. If he also has diabetes (0.302 score) and colorectal cancer (0.307 score), his total score would add up to of 1.295, which in turn would translate to a $1,295 PMPM for the plan covering him[6].

STAR Rating: quality measurement system utilized by CMS to evaluate MA plans. Accounts for member experience, complaints, customer service, managing chronic conditions, and more. They are announced in October based on prior year performance. The ratings have significant implications on plan revenues. A high STAR rated plan receives three benefits:

- Higher quality bonus payments: for example, for a patient with a 1.2 risk score, the difference between a 3-star plan and a 4.5-star plan is almost $140 / month or $1.5k / year. Across 100k members, that equates to a $150M difference[7]. Not small.

- Ability to offer richer benefits: which in turn affects member satisfaction and star ratings

- Real world example: Elevance recently lost its Medicare Advantage Stars lawsuit in Texas, in a case that bizarrely hinged on how to round decimals. The debate? Whether 3.749565 should “round up” to 4 or down to 3.5. The result? Elevance will miss out on an estimated $375 million in bonus payments in 2026, since only 4-star plans qualify[8].

HEDIS Score: stands for Healthcare Effectiveness Data and Information Set. This is the standardized quality measurement system used by the National Committee for Quality Assurance, and is the basis of STARS ratings. Comprised of 81 measures across 5 domains of care. Many members use this score to compare and choose plans.

- Importance: Any payer receiving capitated payments or operating under value-based contracts is paid based on: (1) the quality of the health plans they offer (measured by STAR and HEDIS ratings), and (2) the severity of their insured population (measured by risk scores). This is especially critical in Medicare Advantage, which covered ~33M beneficiaries in 2024 — nearly half of all Medicare members.

- Opportunity: Top priority for payers given direct topline revenue impact. AI-driven solutions are already improving risk score accuracy, enabling real-time ingestion of clinical data, reducing manual coding work, and surfacing new gaps in care. Vendors with strong compliance track records are advantaged given heightened regulatory scrutiny.

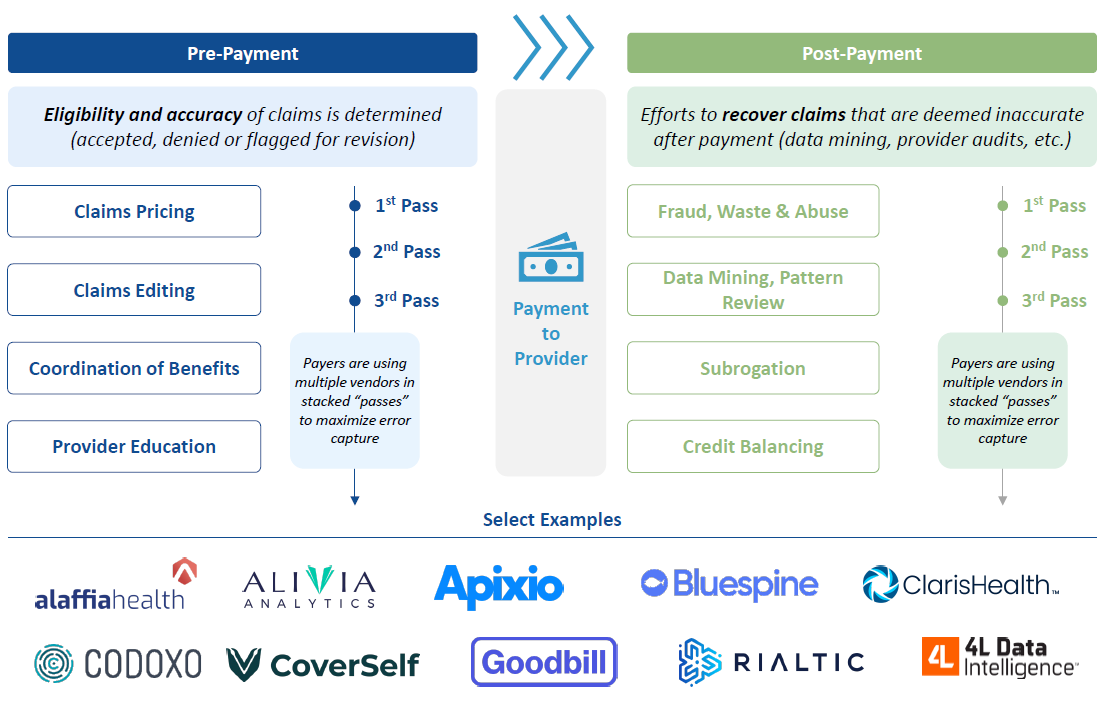

2. Payment Integrity / Fraud, Waste & Abuse (FW&A)

- Description: Solutions that help insurers scrutinize medical bills to identify errors, prevent overpayments, and recover losses. Capabilities span pre-pay functions (ensuring claims accuracy before dollars go out) and post-pay functions (recovering incorrect payments and detecting fraud).

- Importance: Roughly one in three U.S. medical claims is paid incorrectly, contributing to more than $1 trillion in waste annually. Every incorrect claim directly hits payer margins, and recovering overpayments adds additional administrative cost. In a margin‑squeeze regime, payment integrity is the cheapest dollar a plan can earn. And payments is arguably one of the most inefficient categories in the whole US healthcare system.

- Opportunity:

- Payers are prioritizing pre-payment accuracy over the legacy “pay-and-chase” post-payment model

- AI is unlocking faster, cheaper, and more accurate review of complex claims

- The shift to value-based care is adding reimbursement complexity, creating further demand for more sophisticated payment integrity tools

- As tech-enabled players scale, entry for new names is becoming harder. Scaling from regional to national payers is seen as one of the key hurdles to overcome

3. Care Management & Utilization Management

- Description: Platforms that help payers manage member health conditions and control medical spend. Functions include care management (member outreach, care coordination, incentive programs) and utilization management or “UM” (prior authorization and medical necessity review).

- Importance: This category is a central lever for payers to contain costs. Prior authorization alone influences ~80% of medical spend, while care management programs help prevent avoidable high-cost events like hospitalizations or readmissions.

- Opportunity:

- In UM, the automation of “easy” and “medium” prior auth cases is already happening; the largest opportunity is augmenting review of “hard” cases (e.g., approvals for cancer therapies, complex surgeries) that drive most spend. And in care management, AI is enabling smarter care management tools, from identifying at-risk members to supporting proactive interventions.

- There is a general sense of scrutiny in this category, no one wants AI to be the reason why a health plan denies you care (especially if the tool is wrongfully denying care!)

- Despite the spend, ROI remains elusive in this category of solutions for many payers, creating whitespace for solutions that can demonstrate measurable savings

- This category has seen a lot of venture investment, especially in the prior authorization side, so we will not go into detail mapping the landscape

Conclusion

Payers can no longer cut their way to profitability. With vertical integration faltering and traditional levers exhausted, technology has become the backbone to deliver on organic growth. The categories where payers are leaning in — quality and risk adjustment, payment integrity, and care management — are not optional; they are necessities directly tied to revenue capture and cost containment.

We expect adoption to accelerate, consolidation to continue, and valuations to reward platforms that can prove measurable impact. It is an exciting time to be betting on the backbone of our healthcare ecosystem — the payer — and backing the companies that will define the next decade of healthcare technology.

If you are operating or investing in the space, we would love to connect.

[1] Jeff Deverne,“The Big Six Payors: Solving Healthcare’s Toughest Problems,” (Substack, November 24, 2024), https://jeffdelverne.substack.com/p/the-big-six-payors-solving-healthcares?utm_source=publication-search.

[2] Public market data as of September 29th, 2025

[3] Caroline Hudson, “How CVS’ Oak Street bet might play out with private equity,” (Modern Healthcare, June 3, 2024), https://www.modernhealthcare.com/providers/cvs-health-oak-street-private-equity-investment/.

[4] “Justice Department Requires Broad Divestitures to Resolve Challenge to UnitedHealth’s Acquisition of Amedisys,” (U.S. Department of Justice, August 7, 2025), https://www.justice.gov/opa/pr/justice-department-requires-broad-divestitures-resolve-challenge-unitedhealths-acquisition?utm_source=chatgpt.com.

[5] Eric Berger, Caitlin Dowling, Aaron Feinberg, and Rebecca Hammond, “Bain 2024 Provider and Payer HCIT Survey,” (Bain & Company, September 2024), https://www.bain.com/insights/healthcare-it-spending-innovation-integration-ai/.

[6] Celli Horstman, Corinne Lewis, “The Basics of Risk Adjustment,” (The Commonwealth Fund, April 11, 2024), https://www.commonwealthfund.org/publications/explainer/2024/apr/basics-risk-adjustment.

[7] Sachin H. Jain, “Trick Or Treat: The Fuss Over Medicare Advantage Star Ratings,” (Forbes, October 24, 2024), https://www.forbes.com/sites/sachinjain/2024/10/24/trick-or-treat-the-fuss-over-medicare-advantage-star-ratings/ .

[8] Diana Novak Jones, “Elevance Health loses bid to challenge US Medicare star ratings,” (Reuters, August 19, 2025), https://www.reuters.com/legal/litigation/elevance-health-loses-bid-challenge-us-medicare-star-ratings-2025-08-19/.